Late‑Cycle Strategies

- We favor less cyclical, higher-quality businesses that we believe will likely be more resilient to late-cycle dynamics, such as healthcare and pharmaceuticals. We also continue to favor semiconductor companies, while resilient credits in travel and leisure should have upside due to the continued economic reopening.

- Inflation mitigation strategies, including commodities and select currencies, are an essential ingredient for multi-asset portfolios in a late-cycle environment, especially when the world faces wartime price pressures.

- The outlook for continued monetary tightening has created more value in fixed income markets, though other headwinds have us favoring a cautious approach to government bonds, particularly in developed markets. Also, assets such as cash can serve as dry powder to capitalize on dislocations.

Investors today are navigating a global economy in the late stage of the business cycle. Underlying growth appears robust but increasingly vulnerable to downside risk, leading to downward revisions in many growth forecasts. Inflation, already high, has risen further, and markets have priced in rapid monetary tightening as central banks rush to control price spikes.

PIMCO’s business cycle indicators – based on data covering a wide range of macro and market factors – now point to a 98% probability that the global economy is in the second half of the economic expansion. However, although we are in a late-cycle environment, our base case outlook does not include a global recession in 2022 (though we acknowledge meaningful downside risks to growth in several regions, including Europe – for details, please read our latest Cyclical Outlook, “Anti-Goldilocks”). Household and corporate balance sheets are generally healthy, pent-up demand for services has yet to be fulfilled, and continued investment in infrastructure and energy is needed. However, the U.S. Federal Reserve and many other central banks have made it clear that taming inflation is now their primary task. Financial conditions are tightening in response, bringing markets out of the reliably easy monetary conditions to which they had become accustomed.

In the real economy, supply shortages persist in areas ranging from labor to semiconductors. Despite hopes for continued improvement in 2022, the war in Ukraine has further upended supply chains and sent commodity prices surging. We expect elevated inflation will continue to prompt central banks to push interest rates higher, creating differentiation across and within asset classes.

For financial assets, late-cycle behavior historically favors equities and commodities over duration and credit, albeit with more muted returns and higher volatility across the board.

Key themes in multi-asset portfolios

In PIMCO’s multi-asset portfolios, we are following the classic late-cycle playbook. We have reduced overall beta exposure to reflect the lower returns and higher volatility that we expect in this environment. From a cross-asset perspective, we prefer equities versus duration and corporate credit, and within asset classes, we are emphasizing higher-quality exposures. Finally, we hold exposure to assets that may benefit from higher inflation and help diversify portfolios, such as commodities and select currencies.

Equities

Over the past year, many cheaper, more cyclically oriented stocks have delivered strong returns on the back of robust economic growth and risk appetite. But looking ahead, we favor less cyclical, higher-quality businesses that we believe will be more resilient to late-cycle dynamics. We look for companies with steady cash flow, profitability, and sales that can likely weather periods of economic uncertainty.

We have also shifted allocations toward sectors with these characteristics, such as healthcare and pharmaceuticals. Companies in these sectors tend to be less rate-sensitive and are less exposed to rising input costs, the removal of fiscal stimulus, and waning pandemic-fueled demand trends. We also continue to favor semiconductor companies, which historically have been quite cyclical, but have improved balance sheets and should benefit from strong secular tailwinds that will make them less sensitive to headline economic growth through the next cycle.

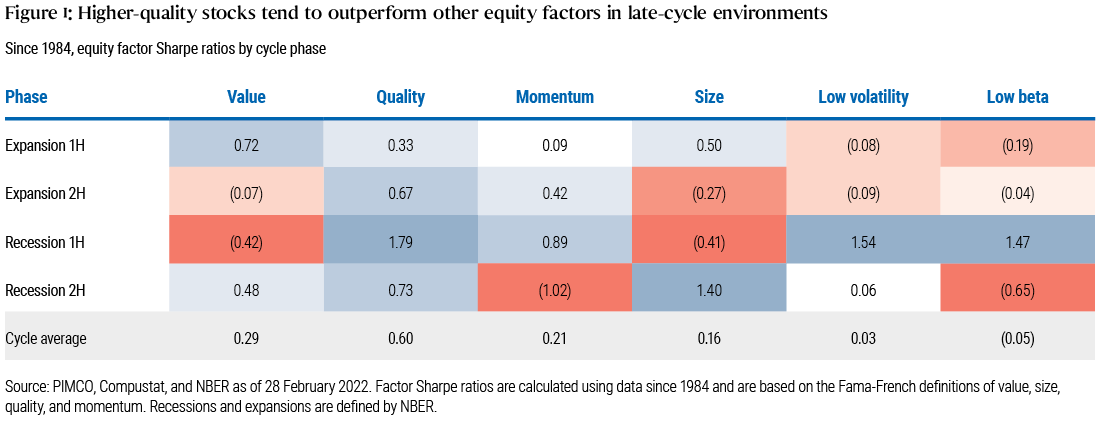

Assessing equities by factor, quality stocks historically have delivered the best risk-adjusted returns during this part of the cycle, while value and small cap stocks usually lag (see Figure 1).

A portfolio can be overweight quality without giving up on growth opportunities. But investors should expand their focus beyond headline growth rates and also focus on the quality of the earnings expansion. This can differentiate truly cash-generative businesses from those whose earnings-per-share (EPS) growth is mere accounting craft.

In PIMCO portfolios, we begin with a quantitative systematic screen that selects companies based on their valuation adjusted for cash generation. This allows us to find not only companies of high quality but also those with high growth that trade at a discount on adjusted multiples. We use three additional criteria: 1) low level of debt, as a clean balance sheet should help companies navigate uncertain environments due to greater flexibility; 2) high and stable margins, as companies that have a historical track record of maintaining or expanding their margins tend to be able to replicate such performance in more difficult parts of the cycle; and 3) high free cash flow generation, as companies able to generate cash can deploy it into dividends, buybacks, or new investments to fuel growth.

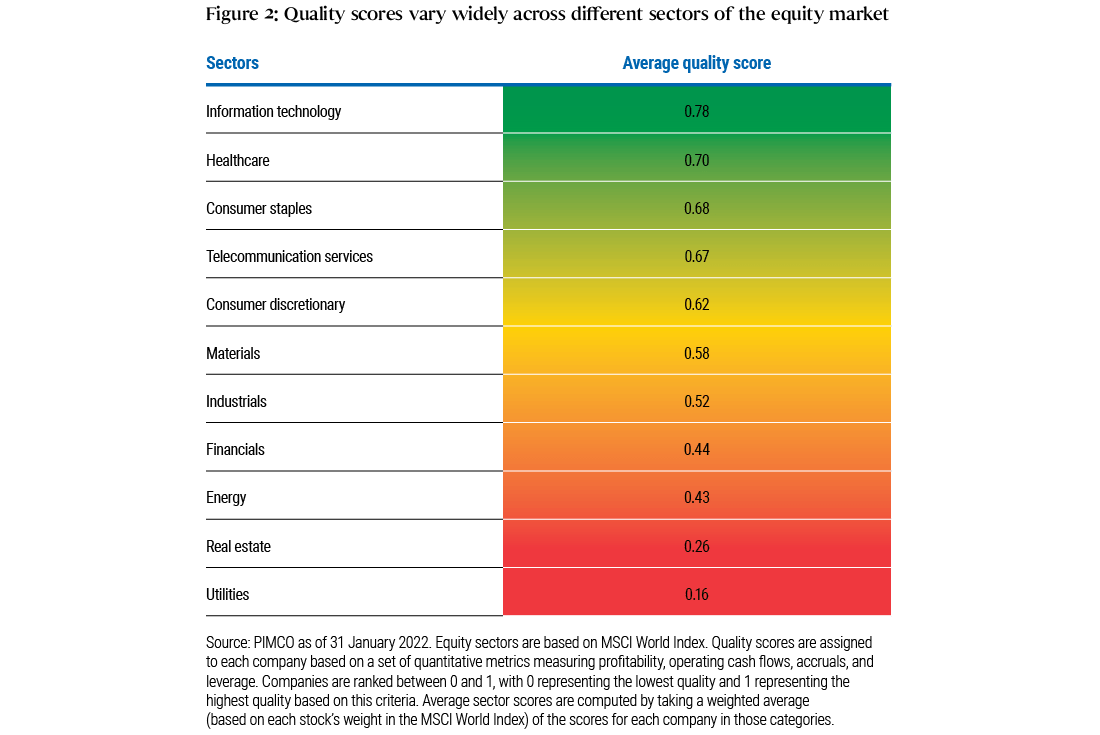

Our next step is more qualitative: We evaluate companies to ensure favorable industry dynamics, fit with our macro and thematic views, and absence of red flags. Looking across equity sectors, we find a wide range of average quality scores of the companies within them, underscoring the importance of analysis at the macro, sector, and company levels (see Figure 2). This framework can help investors navigate late-cycle environments as they pivot toward quality in their equity allocations.

Credit and rates

We see select opportunities in credit markets, and we are focused on companies that should benefit from strong balance sheets and healthy liquidity. Recent widening in spreads has created value in sectors such as financials, which we believe are default remote. Meanwhile, resilient credits in travel and leisure have upside due to the continued economic reopening but still trade wide to pre-pandemic levels.

The rapid monetary tightening priced in by markets has created more value in fixed income markets, but the asset class still faces the headwinds of high inflation, robust growth, and increasing government bond supply as central banks begin to unwind their balance sheets. Nonetheless, bonds have long played an important role as a diversifier in multi-asset portfolios and higher rate levels should bolster their ability to do this going forward. We are modestly underweight developed market duration and prefer to engage in relative value trades in emerging markets (EM) where we see greater dispersion among countries well along in the hiking cycle versus those that are still behind the curve. But if there are further signs of an economic slowdown, we expect duration will become more attractive.

Real assets and currencies

Inflation mitigation is another essential ingredient for multi-asset portfolios in a late-cycle environment, especially when the world faces wartime price pressures as it does today. We favor multiple sources of inflation risk mitigation, and in our portfolios, we are long a diversified basket of commodity-linked currencies and also own real assets, such as commodities.

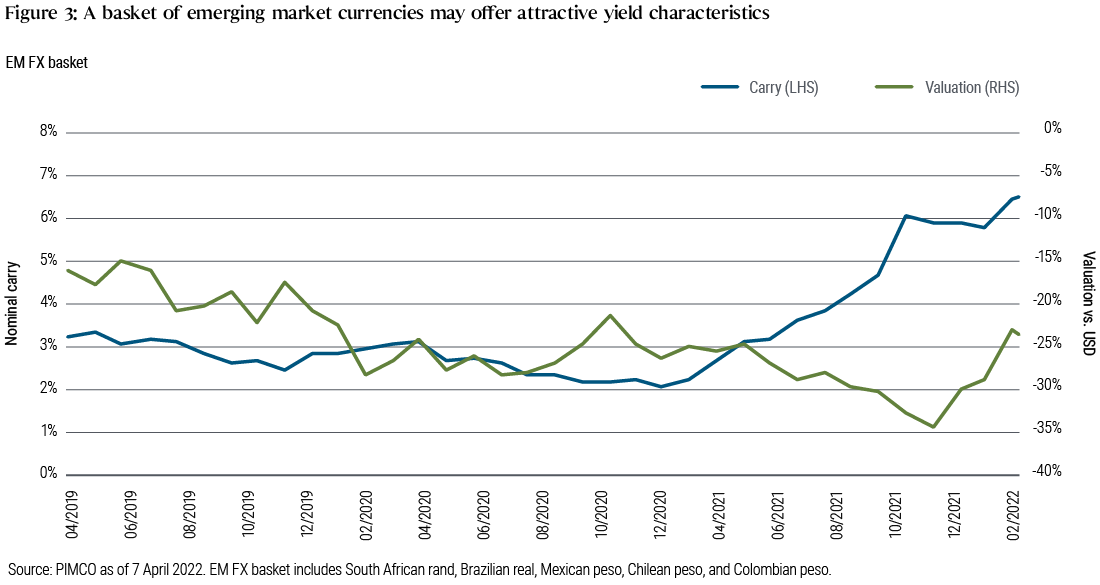

We find emerging market commodity-linked currencies particularly attractive as they offer decade-high levels of carry while being primed for appreciation. For instance, our select basket of EM currencies currently earns a yield north of 6.5%, according to Bloomberg data (see Figure 3). Unlike stocks and bonds, which tend to be challenged in a rising rate environment, select EM currencies may benefit from higher interest rates. This is partially because many EM countries started their hiking cycles ahead of developed market counterparts and, in our view, should retain an attractive yield advantage even as developed rates rise. In addition to the compelling yield profile, valuations of many EM currencies are at their most attractive levels in a decade. For instance, some currencies we hold are trading at discounts to fair value as high as 50%, according to PIMCO’s internal valuation model.

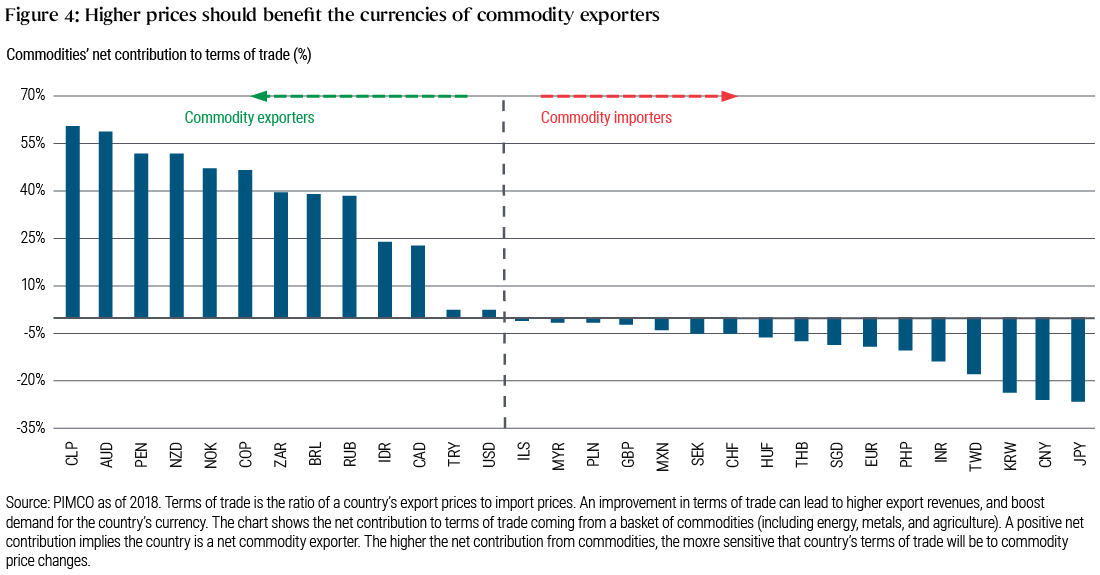

The war in Ukraine represents a massive supply shock to the commodities market. As sanctions and other restrictions limit transactions with Russia, importers need to find alternative sources of energy, metals, and agricultural products. Sanctions are likely to last for some time, in our view, so major commodity exporters should be in a position to benefit from steady demand and higher prices for the foreseeable future and their currencies should benefit as well.

Most of the currencies in our multi-asset portfolios are those of large commodity exporters in both emerging and developed markets, and each country plays an important role as a source of supply for displaced Russian raw materials (see Figure 4). For example, we like the currencies of certain Latin American countries who combine to export oil, metals, ores, and soft commodities.

The Ukraine conflict has likewise added further strain to the world’s green energy transition, with energy independence now also a priority. Russia makes up 14% of the world’s oil supply and is the second-largest producer of natural gas. Russia is no longer considered a reliable supplier, and Europe, which imports 40% of its natural gas from Russia, is attempting to pivot to other sources of energy, which are hard to find. Globally, capex has lagged and inventories in energy and industrial commodities are low, setting the stage for a market that may be in structural deficit for a prolonged period.

These dynamics should keep commodity prices elevated for the foreseeable future, and in our multi-asset portfolios we have added tactical exposure to commodities such as oil. Long term, the case for green energy has only been strengthened by this geopolitical conflict, and we continue to see many attractive opportunities to invest in sectors that will benefit from that transition over the secular horizon.

Investment takeaways

At PIMCO, our conviction is that the economy is in the later stages of expansion, and we are investing accordingly. While it’s always challenging to forecast when the cycle will turn, we believe there is a playbook investors can follow to help build multi-asset portfolios. In a world of slowing growth, tighter financial conditions, rising inflation, and heightened geopolitical tensions, investors should focus on higher-quality companies, both in equity and debt markets, whose business models can withstand the bumps in the road. Investors should also seek exposure to assets that can mitigate further price pressures, such as commodities and EM currencies. Lastly, investors can prepare for further market volatility by retaining exposure to assets that tend to diversify portfolios during flight-to-quality events, such as duration, and that can serve as dry powder to capitalize on dislocations, such as cash. This late-cycle playbook requires careful portfolio construction and the ability to stay nimble as risks and opportunities evolve.

Download our investor handout for details on how we are positioning portfolios across global asset classes.

Featured Participants

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Inflation-linked bonds (ILBs) issued by a government are fixed income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Treasury Inflation-Protected Securities (TIPS) are ILBs issued by the U.S. government. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government-agency or private guarantor, there is no assurance that the guarantor will meet its obligations. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be suitable for all investors. Diversification does not ensure against loss.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fees, and/or other costs. In addition, references to future results should not be construed as an estimate or promise of results that a client portfolio may achieve.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the author and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.