A Framework for Sizing Real Assets to Manage Inflation Risks

- With inflation concerns mounting, it may be advisable for investors to identify a portfolio’s sensitivity to inflation surprises and proactively manage inflation risk.

- Modest allocations to real assets, including TIPS and commodities, can do much to enhance a portfolio’s inflation beta, thereby reducing investors’ exposure to the negative effects of inflation surprises.

- The presented framework seeks to help investors decide how much of a portfolio’s holdings to allocate toward real assets.

After having faded into the background for several years, inflation has once again become a hotly debated topic. Whether one’s expectation is for higher or lower inflation, we believe it is advisable to identify a portfolio’s sensitivity to inflation surprises and proactively manage this inflation risk. We also present a framework to help investors size inflation hedging assets relative to existing portfolio holdings.

In response to inflation risks, many investors are considering real assets such as Treasury Inflation-Protected Securities (TIPS) and commodities to address potential vulnerabilities at the portfolio level.

The benefits of holding some portion of a portfolio in real assets during inflationary periods seem clear. However, when it comes to sizing allocations, solutions are less intuitive. Fortunately for investors, there is a simple, effective framework to optimize real asset allocations, with a focus on inflation hedging and the impact rising inflation could have on a portfolio.

Real assets historically have tended to be effective as inflation hedges

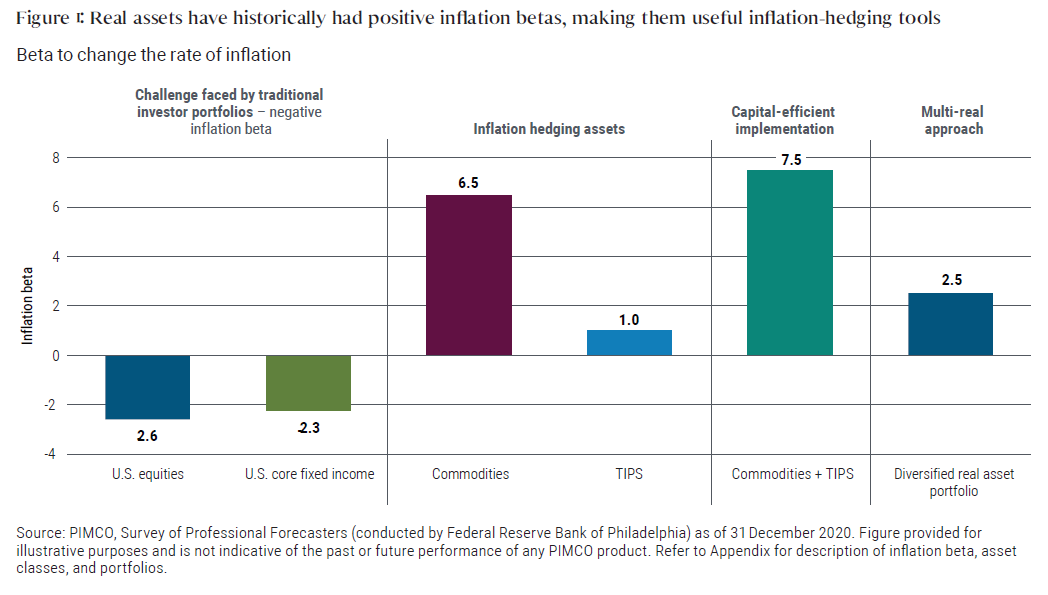

A portfolio’s sensitivity to increases in inflation, known as “inflation beta,” can be quantified by studying the impact that historical changes in inflation surprises have had on returns. Figure 1 illustrates the sensitivity of a variety of asset classes to a 1% unexpected change in inflation. For example, when one-year inflation prints at 2.5%, but the expectation at the beginning of the year was for 1.5%, this represents a 1% inflation surprise.

Studying almost 50 years of data, we observe that nominal asset classes like broad equities and fixed income have had a negative response to inflation surprises, meaning that when inflation increases, asset values generally fall. Real assets, on the other hand, such as TIPS and commodities, have exhibited a positive response to inflation, underscoring their potential effectiveness in mitigating the effects of inflation.

How large an allocation to real assets do investors need?

One way to look at the allocation decision to real assets can be through the lens of inflation risk management. A typical risk management process might look like this:

- Identify a portfolio’s current inflation risk, as well as tolerable inflation risk levels

- Use inflation betas to scale into real assets and out of nominal assets over time until the tolerable level of inflation risk is reached

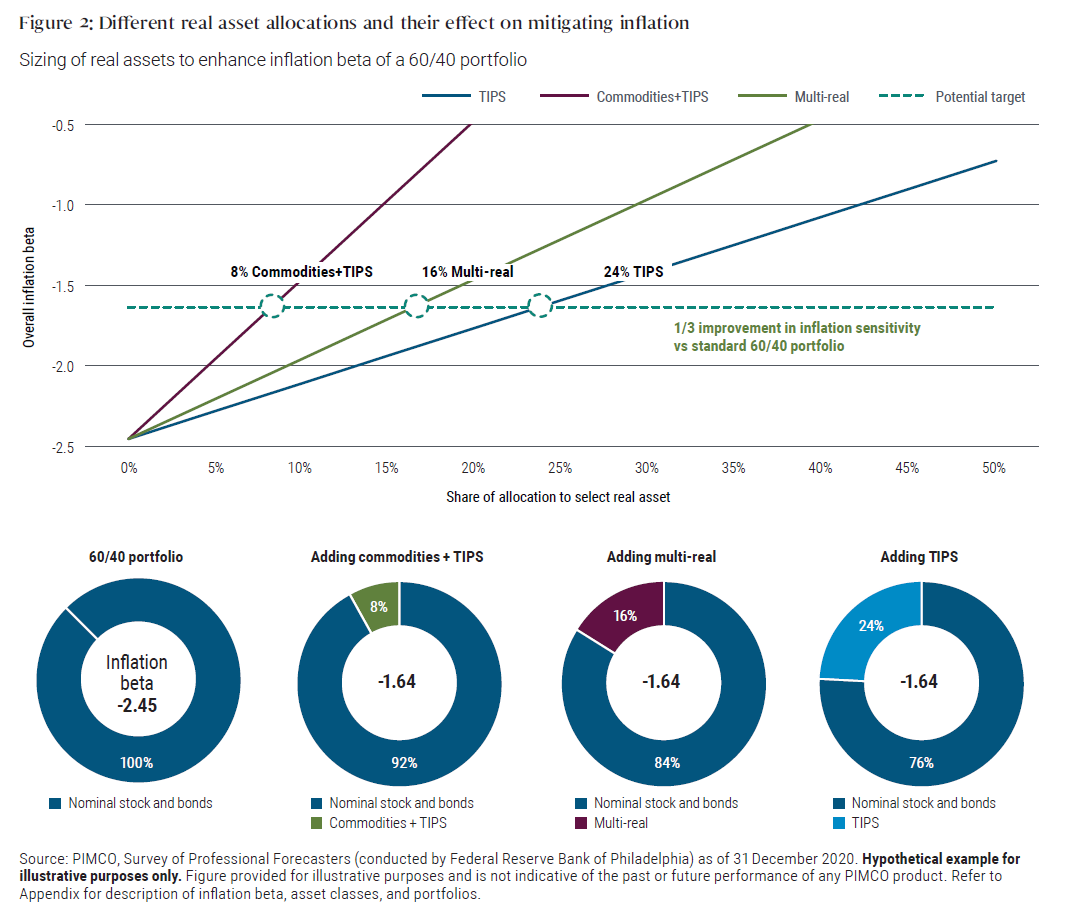

Inflation betas are additive. According to Figure 1, a simple weighted average of the inflation betas of a typical 60/40 portfolio (60% equities and 40% bonds) results in a combined inflation beta of approximately −2.5. In an inflationary scenario, this is clearly a risk to portfolio returns.

The question now becomes, how much of that negative beta does one want to offset and what portfolio shifts would be required? For example, if one were able to reduce inflation risk by one-third, it would already go a long way toward helping address the risk of an inflation surprise. And, as we can see in the next step, that is an entirely reasonable target.

Calculating desired allocations to real assets

To calculate desired allocations to real assets, we use three different types of real assets:

- First, TIPS, with an inflation beta of almost one

- Second, commodities collateralized with TIPS, with an inflation beta of 7.5 (see Figure 1)

- And finally, a multi-real asset allocation for which an investment manager determines the mix of several real asset classes, with an inflation beta of 2.5 (see Figure 1)

As Figure 2 illustrates, modest allocations to real assets can potentially go a long way toward mitigating inflation risk in investors’ portfolios. Note that the more the real asset allocation is tilted towards TIPS, the larger the required allocation to seek a desired improvement in inflation beta. This is because TIPS have an inflation beta of close to 1, essentially hedging the assets invested in TIPS. As a result, one would need about a 24% portfolio allocation to reduce a 60/40 portfolio’s inflation risk by one-third.

By turning to multi-real solutions that make allocations to additional real assets with larger inflation betas, such as commodities, gold, and currencies, investors could seek to achieve the hedge target with a portfolio allocation of approximately 16%. Given the higher return estimates of multi-real portfolios relative to plain TIPS, this represents a compelling implementation option, in our view.

And finally, one of the most capital-efficient inflation hedges available involves allocations to commodities, especially when collateralized with TIPS. Such an allocation has an inflation beta of more than 7, and small allocations may materially improve the inflation beta of the overall portfolio. An approximately 8% allocation to a commodities strategy may reduce inflation beta, or risk, by one-third based on historical data. We do note that allocations to commodities or multi-real asset strategies may also increase portfolio volatility or other risks; a prudent, active management approach can help manage these risks.

Inflation risk can (and should) be managed

Investors concerned about mounting inflation can prepare ahead of time and help prepare portfolios with allocations to real assets that are expected to have a positive response when inflation surprises to the upside. If investors are thoughtful about which inflation solutions to choose, even modest adjustments to the overall portfolio allocation can potentially lead to a meaningful reduction in investors’ exposure to inflation.

Appendix

Inflation beta represents sensitivity of asset class excess returns (over the “risk-free” rate) to inflation surprises in two-factor GDP growth and inflation surprise (realized inflation minus Philadelphia Fed Survey inflation forecast) model (i.e., when inflation surprises by +1%, an asset with an inflation beta of 1.5 is expected to have an excess return of 1.5%, all else equal); based on quarterly rolling annual data from 1973 to 2020 and since 1997 for TIPS. U.S. equities: S&P 500 Index; U.S. core fixed income: Bloomberg Barclays U.S. Aggregate Index; Commodities: Bloomberg Commodity TR Index; TIPS: Bloomberg Barclays U.S. TIPS Index; TIPS + Commodities: equally weighted allocation to the prior identified indexes; Diversified real asset portfolio: PIMCO Inflation Response Index (45% Bloomberg Barclays U.S. TIPS Index, 20% Bloomberg Commodity Index Total Return, 15% JPMorgan Emerging Local Markets Index Plus (Unhedged), 10% Dow Jones U.S. Select REIT Total Return Index, 10% Bloomberg Gold Subindex Total Return Index).

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Inflation-linked bonds (ILBs) issued by a government are fixed-income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Treasury Inflation-Protected Securities (TIPS) are ILBs issued by the U.S. government. Commodities contain heightened risk including market, political, regulatory, and natural conditions, and may not be appropriate for all investors. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. REITs are subject to risk, such as poor performance by the manager, adverse changes to tax laws or failure to qualify for tax-free pass-through of income.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

This article contains a hypothetical illustration. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

Bloomberg Commodity Index Total Return is an unmanaged index composed of futures contracts on 20 physical commodities. The index is designed to be a highly liquid and diversified benchmark for commodities as an asset class. Bloomberg Gold Subindex Total Return Index reflects the return on fully collateralized positions in the underlying commodity futures. Bloomberg Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. Bloomberg Barclays U.S. TIPS Index is an unmanaged market index comprised of all U.S. Treasury Inflation-Protected Securities rated investment grade (Baa3 or better), have at least one year to final maturity, and at least $500 million par amount outstanding. Performance data for this index prior to October 1997 represents returns of the Bloomberg Barclays Inflation Notes Index. The Dow Jones U.S. Select Real Estate Investment Trust (REIT) Total Return Index is a subset of the Dow Jones Americas Select Real Estate Securities Index (RESI) and includes only REITs and REIT-like securities. The objective of the index is to measure the performance of publicly traded real estate securities. The indexes are designed to serve as proxies for direct real estate investment, in part by excluding companies whose performance may be driven by factors other than the value of real estate. Prior to April 1st, 2009, this index was named Dow Jones Wilshire REIT Total Return Index. JPMorgan Emerging Local Markets Index Plus (Unhedged) tracks total returns for local-currency-denominated money market instruments in 22 emerging markets countries with at least US$10 billion of external trade. S&P 500 Index is an unmanaged market index generally considered representative of the stock market as a whole. The Index focuses on the large-cap segment of the U.S. equities market. It is not possible to invest directly in an unmanaged index.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2021, PIMCO.