Asia Market Outlook 2021: Attractive Opportunities As Economies Rebound

In our latest Cyclical Outlook, “Bounded Optimism on the Global Economy ” we described our expectations that global output and demand are likely to rebound strongly in 2021, driven by the rollout of vaccines and continued fiscal and monetary policy support. We noted that the Chinese economy, which already operates above pre-crisis levels and has exhibited strong growth momentum into the new year, should record GDP growth above 8% in 2021, after a decidedly subpar 2% or so last year. However, one of the three key risks to our outlook was the likely transition in China from credit easing to tightening in the course of the year.

We expect to see a rebound in the economies of India and Indonesia also during the course of this year, with government stimulus supporting public investment and consumption, although private investment continues to contract. For both countries, the swing factors will be COVID-19 containment and effective vaccination programs.

For the APAC region, recent trade deals will likely invigorate and deepen economic integration over the coming few years. In late 2020, China, Japan, South Korea, Australia, New Zealand and 10 Association of Southeast Asian Nations (ASEAN) members signed the Regional Comprehensive Economic Partnership (RCEP) agreement after eight years of negotiation. When fully implemented in 2022, RCEP will represent the world’s biggest trading bloc, covering about 30% of global GDP and trade. In addition, China concluded a Comprehensive Agreement on Investment (CAI) with the EU on the last day of 2020. The EU is China’s second-largest trading partner and the CAI will cover broad market access, including to key sectors such as alternative energy vehicles and medical services.

Although these trade deals will not have an immediate economic impact, in the medium term the treaties should cement Asia as the world’s most dynamic economic bloc embracing free trade, investment and globalization. They should also help to counter the disruptive geopolitical tensions and encourage the post-pandemic economic recovery in Asia.

Potential Asia investment opportunities in 2021

- Chinese yuan (CNY) foreign exchange (FX) and local duration exposure

- China’s new economy and consumer sector credits

- Unhedged Indonesian local currency bonds

- Indian rupee (INR) FX exposure

China: A steady recovery with fiscal policy remaining supportive

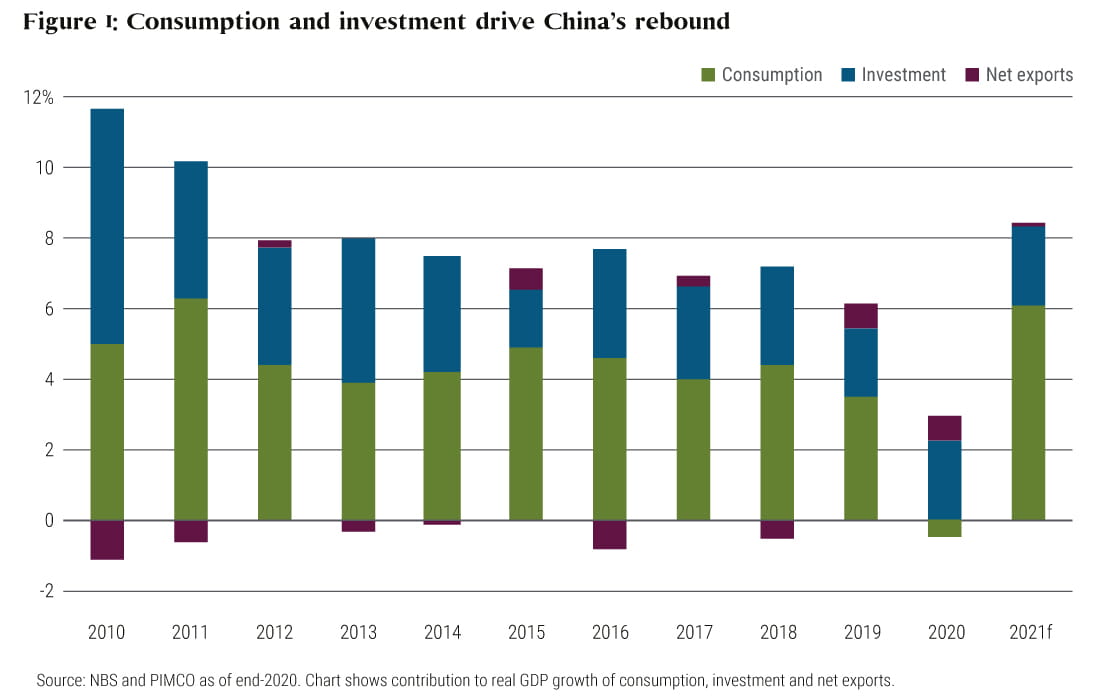

The rebound in China’s GDP to around 8% in 2021 will likely be driven by consumption and services (see Figure 1). While infrastructure and real estate investment should moderate from 2020 as the government’s stimulus measures phase out, we expect manufacturing investment to pick up, benefiting not only from improving corporate profits and business sentiment but also from government support for industry upgrading and supply-chain localization.

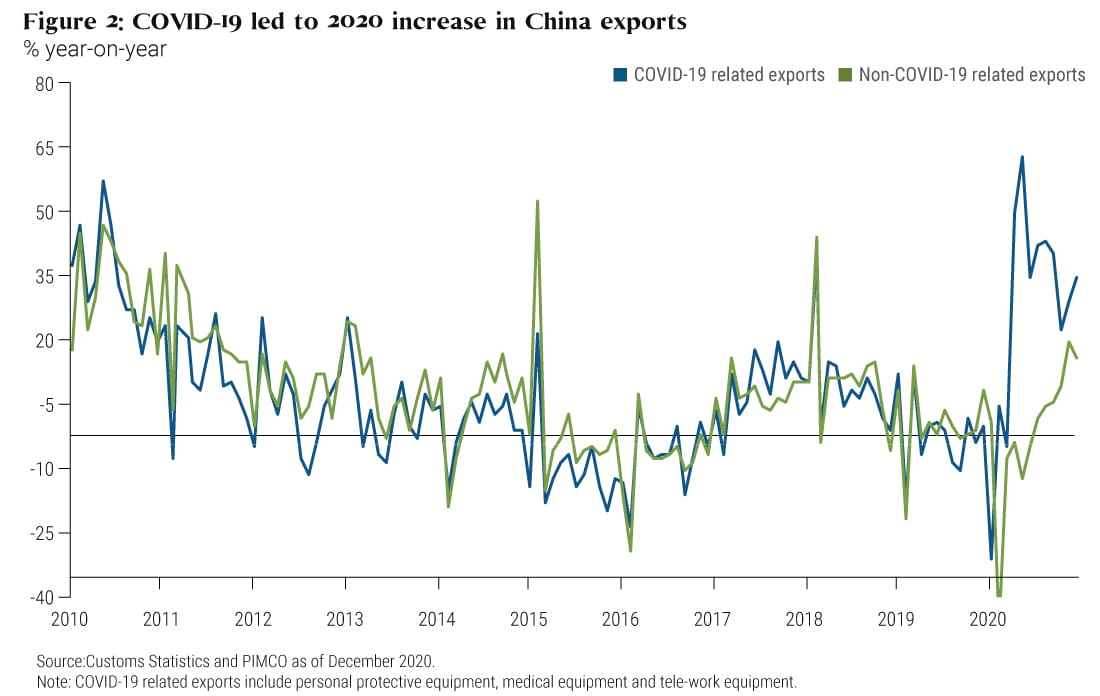

Chinese exports gained market share in 2020, mainly due to strong demand for personal protective equipment and telework equipment (see Figure 2). However, we expect some mean-reversion in 2021 when global production capacity catches up and vaccines become more widely available, although recovery in global demand will provide some support. Consumer price index (CPI) inflation should be moderate, with pork prices normalizing and core inflation picking up, along with a recovery in consumption.

We expect fiscal policy to remain supportive, but stimulus levels will be lower than in 2020. As for monetary conditions, credit growth will ease from the spike in 2020. We expect interest rates and the reserve requirement ratio (RRR) to remain unchanged, but the People’s Bank of China (PBOC) could use targeted measures to support key industries and adjust market conditions. Risk mitigation policies will regain momentum in overheated sectors, particularly housing.

Downside risks include an unexpected re-escalation of U.S.-China tensions under the administration of U.S. President Joe Biden and over-tightening of macro policies, which could cause weaker economic growth, market volatility, or both. While China’s domestic activity is relatively resilient to COVID-19 due to its mostly successful management of the virus spread, public health concerns will remain a constraint for further recovery in some service sectors. It is also possible that Biden continues with some of the more confrontational policies put in place by former President Donald Trump. Domestically, China’s annual Central Economic Work Conference (CEWC) in December pledged that there would be no policy cliff, easing market concerns on over-tightening.

2021 is the first year of China's 14th five year plan (2021-2025), which we believe should imply a stable economic outlook. We expect the government will continue to emphasize quality growth and risk mitigation. While demand-side reforms will further boost Chinese consumption by strengthening the social safety net and promoting access to services and goods, they will also create new investment opportunities for high-tech, high-quality, and more environmentally friendly manufacturing and infrastructure. With China’s new ambitious climate targets (such as carbon neutrality by 2060), not only will the government provide policy support to the green economy, but private capital is likely to flow into related industries. There are significant potential opportunities in China’s new energy sector, including wind and solar power, electric cars, energy storage systems, green infrastructure, and environmental-related equipment and services.

Indonesia: Currency and government bonds well-anchored

We expect the Indonesian economy to rebound to around 4.8% in 2021 from the -2% contraction in GDP in 2020, which was its deepest recession since the 1998 Asian Financial Crisis. The COVID-19 pandemic has hit both tourism and domestic consumption, although commodity prices and exports recovered quickly in the second half of 2020. Government stimulus has been supporting public investment and consumption, with mining and manufacturing exports also rebounding strongly. However, private investment remains in contraction, while household income and domestic consumption remain sluggish.

In response to the pandemic, the Bank of Indonesia (BI) cut its policy rate by 125 basis points (bps) to 3.75% in 2020 and launched a quantitative easing (QE) program to support government debt issuance, of which it has purchased 40% of net issuance. We expect BI to cut interest rates by a further 25-50 bps to 3.25%–3.50% this year. With inflation (CPI) projected to be a benign 2% in 2021, below BI’s target range of around 3%, and an improving current account balance, the central bank has room to cut, even while continuing to anchor long-term bond yields via QE in both the primary and secondary bond markets.

On the fiscal side, we expect a move towards consolidation. In response to the pandemic’s unprecedented shock to the economy, policymakers suspended the 3% budget deficit cap from 2020-2022. With a projected budget deficit of 6.4% in 2020 and 5.8% in 2021, policymakers are committed to consolidating the deficit back to 3% or less by 2023, although this may prove challenging.

The key macroeconomic risks to our outlook are the continuing impact of the pandemic hampering economic recovery and straining social stability, and the effectiveness of a vaccine rollout program in the second half of the year. It is worth noting that the allocation of fiscal stimulus funds in 2020 was slow, although we believe that leaves room for an additional fiscal boost in 2021. In addition, any global shocks that lead to a disruptive sell-off in the currency, bond or equity markets could severely constrain the ability for further coordinated monetary and fiscal easing.

While there is some risk to its sovereign credit rating given the higher deficits, we believe Indonesian rupiah (IDR) foreign exchange, local currency government bonds and U.S. dollar-denominated sovereign bonds are quite well-anchored. Indonesia’s benign debt and leverage levels put the country on a solid investment grade footing before the start of the pandemic. During the last decade, the government debt-to-GDP level has declined from 57% in 2004 to 41% in 2020. Similarly, external debt has declined from 55% of GDP to 36% of GDP. BI’s official international reserve of USD135 billion provides a strong buffer for both IDR and government bonds. Unhedged Indonesia local currency bonds provide a decent income-generation opportunity with a supportive central bank and higher yields versus comparable markets.

India: Further rate cuts unlikely due to elevated inflation

We expect the Indian economy to rebound to around 8.5% in 2021 from -9.7% in 2020. While government stimulus is supporting consumption and agriculture, exports and manufacturing are rebounding, too. However, private investment remains in contraction for the fifth quarter in a row (as of 3Q 2020). We expect activity won’t fully recover pre-COVID levels until 2022.

We expect CPI to be slightly higher than the consensus (4.3%), reaching 4%-5% in calendar year 2021. Despite weak demand and oil prices, widespread supply chain disruption and unfavorable food prices should keep both headline and core CPI above 5%. We also expect the Reserve Bank of India (RBI) to maintain interest rates at 4% for some time. After slashing rates by 115 bps in response to the pandemic, the RBI’s ability to cut further is constrained by this elevated inflation, its focus on using QE to maintain ample liquidity in the financial system, and the need to digest the heavy supply of fiscal issuance required due to higher deficits. The pandemic stimulus package will bring the financial year 2021 (ending March 2021) central government deficit to a record 7.5% of GDP (general government deficit, and 12% of GDP if including state deficits). Although the economy is slowly recovering, further stimulus will be necessary to sustain the economic rebound. We expect the central government deficit will fall slightly to 6% of GDP in financial year 2022.

The main risks we see are uncertainty surrounding COVID-19 containment and the effectiveness of a vaccine program in the second half of the year. There is also continuing deleveraging pressure in the financial system and corporations, which may weaken the transmission of stimulus funding to the private sector. In addition, rating agencies Moody’s and Fitch have put India’s BBB- sovereign rating on a negative outlook based on elevated government debt, a high deficit, and stress in the financial system. Although India doesn’t have sovereign external bonds, losing its investment grade sovereign rating would nevertheless put pressure on quasi-sovereign and corporate credit.

We do see opportunities in the potential appreciation of its currency. India’s current account has been running in surplus, with a projected level of USD 39 billion or 1.5% of GDP this year, for the first time since 2007, given weak imports and oil prices. Along with strong foreign direct investment and equity flows, the balance of payments surplus ran above 3% of GDP in 2020. In our view, the RBI will likely continue to build up FX reserves and allow an increased degree of appreciation of the Indian rupee.

A time for careful portfolio positioning

Within the context of a gradual global recovery, we are constructive on the macroeconomic picture in Asia. Granted, the markets have priced in recovery to a decent extent and there may be renewed bouts of volatility in financial markets, but we are poised to take advantage of opportunities as they arise. For 2021, we are focused on identifying country-specific opportunities and carefully selecting credit positions where we see value and remote default risk.

For information on our outlook for the global economy in 2021 and the investment implications, please read our Cyclical Outlook, “Bounded Optimism on the Global Economy .”

Featured Participants

Disclosures

All investments contain risk and may lose value. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2021, PIMCO.