Don’t Fight the Fed, But Don’t Lose the Thread

- The Fed’s abrupt pivot toward significantly hawkish monetary policy rattled markets in the past year.

- The Fed remains focused on its price stability mandate, but several factors – including financial conditions, real interest rates, and wages – will be key in determining the peak policy rate that can achieve that mandate.

- Avoiding at least a modest recession will be a challenge: The Fed’s instruments are blunt, the mission is complex, and difficult trade-offs lie ahead.

This is my first installment of a series of essays exploring global economic and financial themes. While many of these essays (including today’s) will focus on the U.S. Federal Reserve as one of the world’s major monetary policymakers, in future essays I will also offer my perspectives on the global economy and financial markets more broadly. My aim is to help readers extract signal from noise and spot emerging trends hidden in the gusher of economic and financial data that flood our inboxes and fill our screens every day.

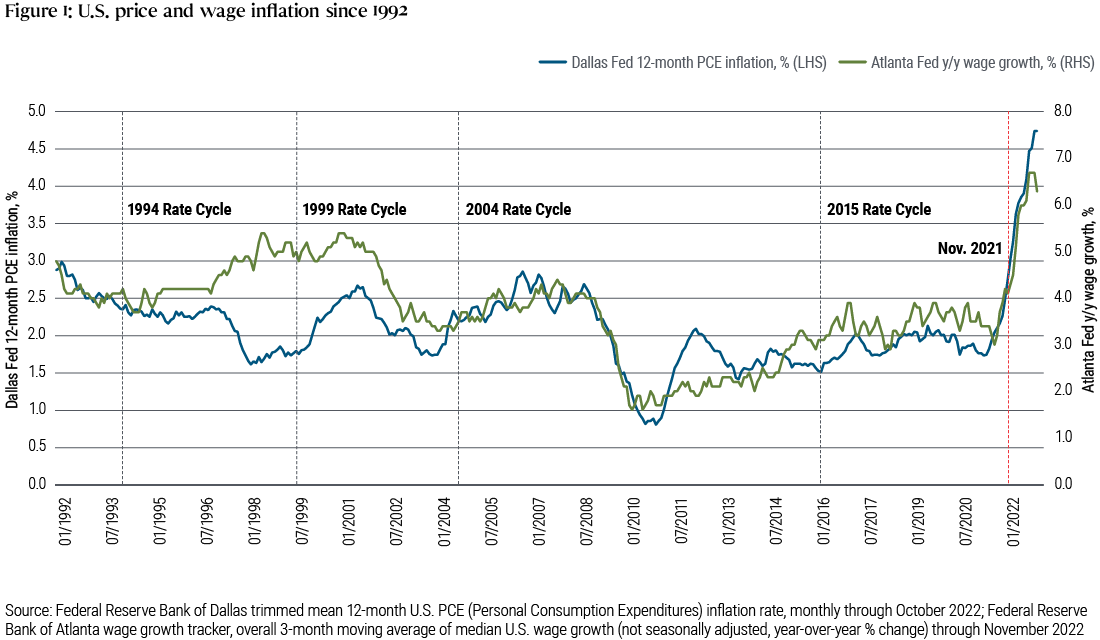

We’re concluding a turbulent year in U.S. and global financial markets – and a deeply painful one for most investors. Major drivers of the tumult were the decisions by the Fed and other major central banks to undertake abrupt and correlated (if not coordinated) hawkish monetary policy pivots to try to get ahead of an inflation curve that has turned out to be hockey-stick steep, distressingly persistent, and broadly evident in both price and wage data (see Figure 1).

The Fed’s December Summary of Economic Projections indicate that many on the Federal Open Market Committee (FOMC) project that the top of the federal funds rate range could end next year at 5.25%. Whether or not a projected policy rate of 5.25% will be sufficient to restore price stability will depend on at least three factors.

A hawkish pivot in Fed policy

The Fed’s hawkish pivot actually commenced at the November 2021 FOMC meeting with the announcement that the quantitative easing program would taper and end earlier than had been expected. The pivot continued in March of this year with an initial 25 basis point (bp) rise in the federal funds rate, followed in May with a 50-bp hike and the introduction of a muscular quantitative tightening (QT) program that would commence in the summer, followed in June by a 75-bp hike that would then be repeated at three more consecutive FOMC meetings, followed in December by a downshift to a 50-bp hike as the committee in its words continues to “… take into account the cumulative tightening of monetary policy [and] the lags with which monetary policy affects economic activity and inflation …”

This cumulative 425-bp increase in the federal funds rate over a period spanning just nine months represents the most aggressive Fed rate-hike cycle in more than 40 years. These rate hikes, along with the QT program and the committee’s forward guidance about the expected future path of the policy rate, have together tightened financial conditions considerably: Nominal and inflation-adjusted bond yields have reached levels unseen in at least 15 years, and five-year, five-year-forward breakeven inflation rates have generally stabilized at levels consistent with the Fed’s 2% inflation objective (suggesting investors believe U.S. inflation will be tamed in the longer run). Moreover, the FOMC’s latest Summary of Economic Projections (SEP), published in December 2022, suggests that many on the committee believe that with several additional rate hikes at the first several meetings in 2023, it will then be in a position to pause and assess whether the stance of monetary policy, if sustained, has tightened financial conditions sufficiently to bring aggregate demand back into line with available aggregate supply. Such a balance would help facilitate the return of inflation to the Fed’s long-run goal of 2% over its forecast horizon.

Three key themes for the Fed in 2023

At least three factors will be crucial in determining whether the federal funds rate of 5.25% that is implied by the December SEP will be sufficient to restore price stability in the U.S.

The first factor is the risk of a disconnect between Fed forward guidance and financial conditions. Several times in 2022 – most notably after the July FOMC meeting – financial conditions actually eased for a time, either because investors doubted the Fed would eventually push the policy rate into restrictive territory (more on that below) or they doubted that the Fed would keep the policy rate in restrictive territory for very long once it reached the presumed peak level. As Fed Chair Jerome Powell said at the Brookings Institution on 30 November, “We do not want to overtighten because we think cutting rates is not something we want to do soon,” but if financial conditions ease because markets price in such cuts, a peak policy rate of 5.25% may not be sufficient to put inflation on a path to return to 2% over time.

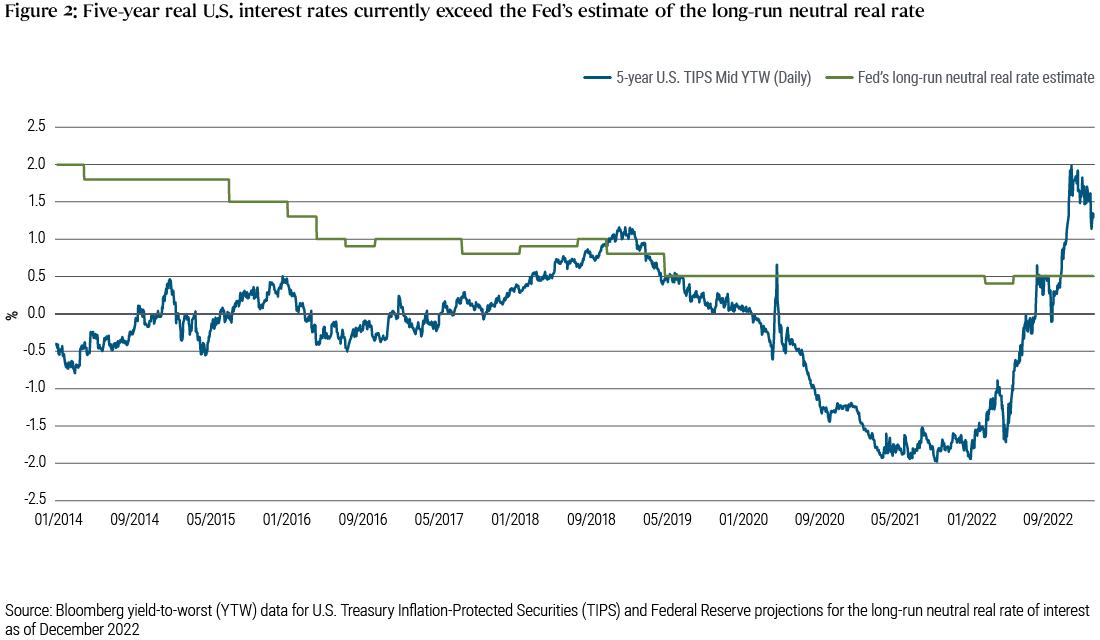

A second crucial factor in determining the peak fed funds rate this cycle is the level of the policy rate required to push expected real interest rates into restrictive territory. The December SEP projections continue to show that the committee believes that the long-run neutral real interest rate is around 0.5%, which compares with the current (as of this writing) yield on five-year U.S. Treasury Inflation-Protected Securities (TIPS) of about 1.4% – see Figure 2. So by this market-based measure, five-year real interest rates now exceed the Fed’s estimate of neutral. The Fed likely sees this market pricing as an indication that its policy is moving into the restrictive territory needed to slow aggregate demand growth and eventually put downward pressure on inflation. More generally, Fed rate hikes, forward guidance, and QT have together tightened indices of financial conditions, and the Fed will likely aim to calibrate the destination for the federal funds rate in the context of broader financial conditions and not just with reference to its current estimate of the neutral real interest rate.

A third factor important to determining when and at what level this hiking cycle peaks is the ultimate rise in U.S. unemployment that will be required to ease cost-push pressures in a labor market with wage inflation (net of underlying productivity) running well above the pace consistent with the Fed’s long-run price stability objective of 2%. Although recent readings on U.S. Consumer Price Index (CPI) inflation are moving in the right direction, wage inflation at present is running above a 5% annualized rate (refer to Figure 1) and underlying productivity is, charitably, estimated to be growing at around a 1.25% pace (source: U.S. Bureau of Labor Statistics (BLS)), implying that wage inflation would eventually need to decelerate by 1 to 2 percentage points for the Fed to be confident that its 2% inflation goal can be reached. Historically, declines in U.S. wage inflation of this magnitude have only occurred in recessions, and the Fed itself in the December SEP projects the unemployment rate will rise to 4.6% by the end of 2023, more than a percentage point higher than the 3.5% unemployment rate recorded in September of this year (source: BLS). By way of reference, the unemployment rate rose by 1.3 and 1.2 percentage points respectively and wage inflation decelerated by 1.0 and 0.8 percentage points respectively in the relatively mild recessions of 1990 and 2001 (sources: BLS and Atlanta Fed, respectively). While these historical comparisons are instructive, it is clear that the post-pandemic labor market has changed in fundamental and complex ways, and there has to be a great deal of uncertainty as we enter 2023 about how much adjustment in the labor market will ultimately be required to reduce wage inflation to a pace consistent with price stability.

In sum, averting at least a modest recession under present circumstances will be challenging: The Fed’s instruments are blunt, the mission is complex, and difficult trade-offs lie ahead. As Chair Powell indicated at Jackson Hole in August 2022, he and the FOMC are determined to ensure that the hard-won battles under prior Chairs Paul Volcker and Alan Greenspan to achieve price stability are not squandered. In that brief speech, Powell stated – twice – that the Fed will “keep at it until the job is done.” I have every confidence that the FOMC will indeed endeavor to keep at it until the job is done, although the journey to that destination will require the Fed to be nimble and to persevere.

Featured Participants

Disclosures

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

References to specific securities and their issuers are not intended and should not be interpreted as recommendations to purchase, sell or hold such securities. PIMCO products and strategies may or may not include the securities referenced and, if such securities are included, no representation is being made that such securities will continue to be included.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.