Building Resiliency Amid Uncertainty

- Our baseline economic forecast calls for a gradual but uneven healing of global activity. But we also see substantial risks, and we believe building resilient portfolios is key.

- The pace of the recovery will affect various regions, industries, and individual companies differently, and we believe active management remains critical to add value through sector selection and tactical asset allocation.

- Our analysis suggests that valuations of risk assets (equity and credit) are approximately fair, and we believe investors should maintain a moderate risk-on stance while balancing caution with conviction.

- We favor companies that are positioned to deliver robust earnings despite a tepid macroeconomic environment. This approach emphasizes quality and growth in equity portfolios and “bend but not break” investments in credit markets.

After a decade of steady growth and rising asset prices, economies and financial markets were rocked by the COVID-19 pandemic. The global health crisis forced most governments to lock down their communities, halting economic activity almost overnight and causing financial markets to reprice lower at an unprecedented speed. Policymakers responded with extraordinary monetary and fiscal support measures, leading to an equally dramatic upside move in risk assets.

The challenge facing investors today is how to construct portfolios in an environment where asset prices appear disconnected from the real economy and the resolution of the health crisis is murky. Our analysis suggests that valuations of risk assets (equity and credit) are approximately fair, after adjusting for easy financial conditions and assuming a gradual economic recovery. Nonetheless, the distribution of potential economic scenarios over the next 12 months is unusually wide. Will there be a V-shaped recovery as businesses reopen? Or will the emergence of a second wave of the virus further stall economic activity? These questions cannot be answered with certainty. Therefore, investors should consider building portfolios that can weather a range of future paths.

PIMCO currently favors a modest risk-on posture within multi-asset portfolios, emphasizing resiliency in equity and credit exposures. As always, robust portfolio diversification is critical, but achieving this requires a multi-faceted approach. Duration, real assets, and currencies all can play an important role. One silver lining is that volatility and uncertainty often lead to great investment opportunities. We believe portfolios that are thoughtfully constructed, well-diversified, and sufficiently nimble should be in the best position to navigate the months ahead.

A bumpy macroeconomic outlook

PIMCO’s base case is that the economic recovery will be gradual and uneven, with many economies not returning to their pre-crisis GDP levels until 2022. Along with the base case, our outlook encompasses other potential paths, good and bad. Under the optimistic scenario, the rapid development of a medical treatment for the virus would enable economies to re-open and normalize more quickly than is currently anticipated. The pessimistic scenario involves a strong and widespread second wave of the virus that forces governments to renew social distancing policies. This could lead to a double-dip recession and result in permanent business closures and job losses. In aggregate, while our base case assumes a gradual improvement in economic data, the risks appear skewed to the downside. However, it seems fairly clear that policymakers are committed to further easing, even if better-than-expected economic indicators prevail, creating a plausible upside scenario as well.

Current state of risk asset valuations

It would be an understatement to say that we are going through unprecedented times both in our lives and as investors in financial markets. The pandemic unleashed the fastest bear market in history: At its lowest point, the MSCI All Country World Index hit −32.9% for the year, and it took only 40 calendar days for a −34.8% peak-to-trough correction. Global investment grade credit spreads (per the Bloomberg Barclays Global Aggregate Corporate Index average option-adjusted spread) also widened significantly, exceeding 400 basis points (bps) at the peak.

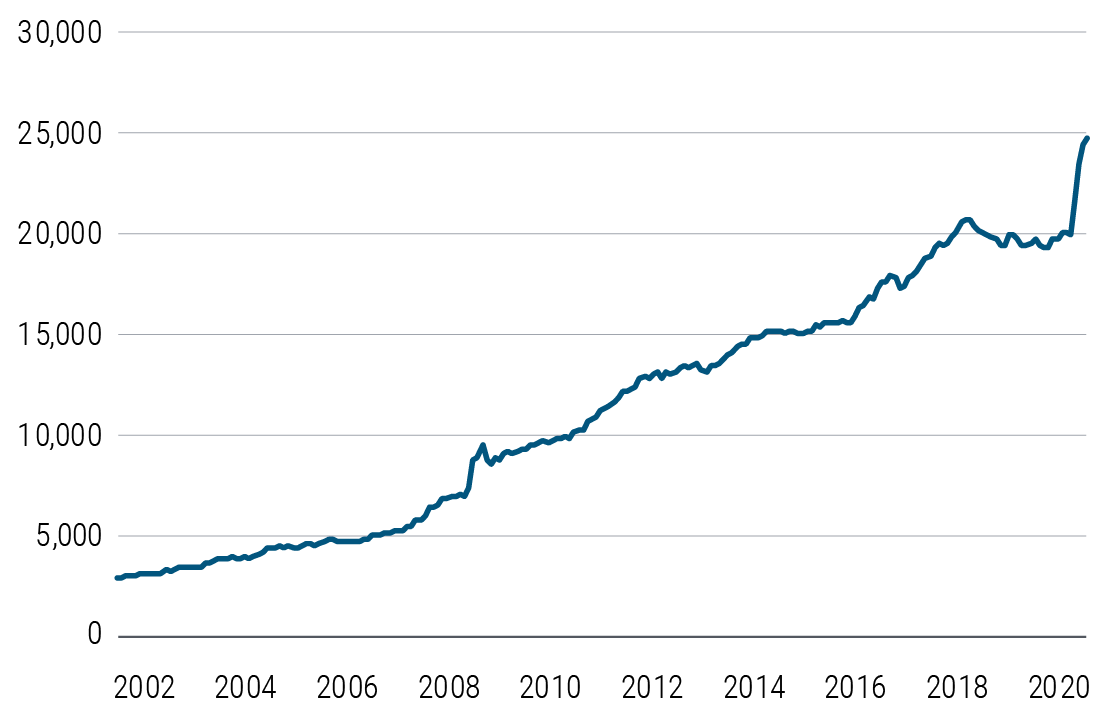

Yet the bounce has been equally impressive. The deepest and sharpest recession in modern history is being matched with the biggest synchronized monetary and fiscal efforts globally ever seen. Figure 1 shows one key monetary indicator – the dramatic rise in the size of central bank balance sheets across major economies.

These offsetting forces are now causing confusion on the fair value of risk assets. On one hand, in this poor fundamental environment of collapsing economic activity and rising unemployment, corporate earnings are due to fall precipitously, leverage is likely to increase significantly, dividends have been cut or suspended, and nonperforming loans on banks’ balance sheets are likely to rise. On the other hand, policymakers have unleashed a huge fiscal and monetary response in an effort to provide market liquidity, lend support to companies, and provide benefit checks and assistance to households. Furthermore, numerous central banks around the world have acted not only as a lender of last resort, but also as a buyer of last resort, ensuring financial markets operate more smoothly.

Yet even though volatility in the financial system has decreased significantly since the lows in mid-March and the worst-case economic scenarios seem to have been averted, merely avoiding the worst is not the same as returning to an environment of growing profits and buoyant economic activity. Depending on which side of the optimistic-versus-pessimistic equation one assigns more importance, risk assets could be viewed as “rich” or "cheap." In this environment, approaches that rely solely on valuation anchors and comparisons with history to make this judgment are challenged (or rendered obsolete) because we are encountering unprecedented shocks, and the range of future outcomes remains extremely wide.

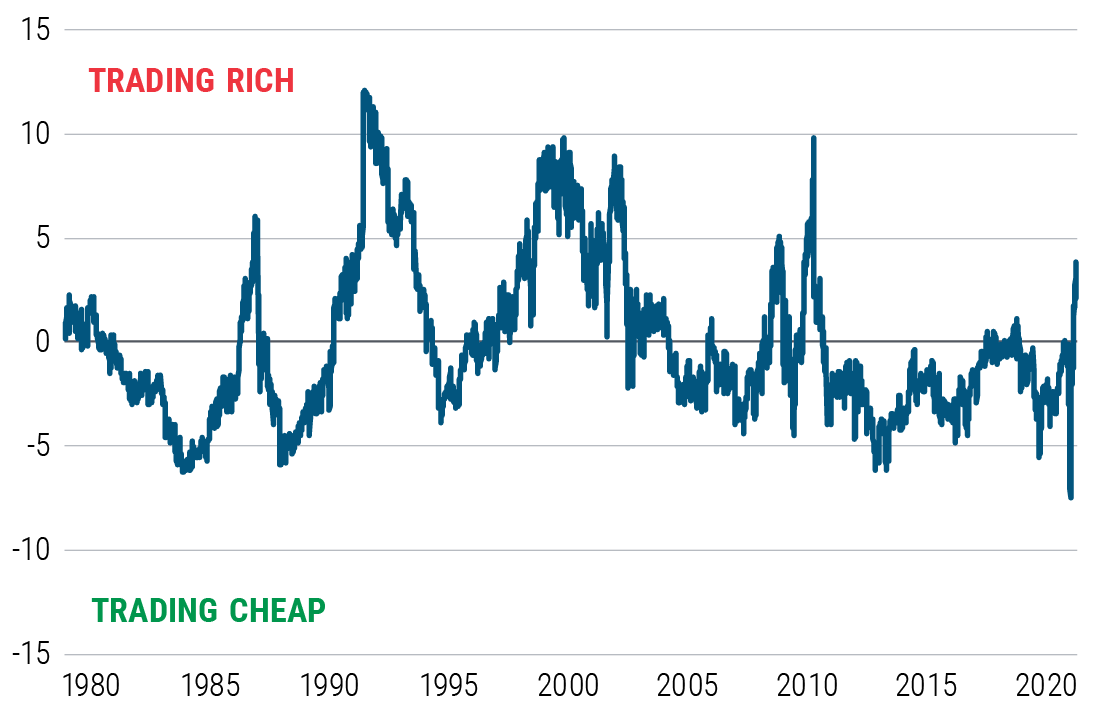

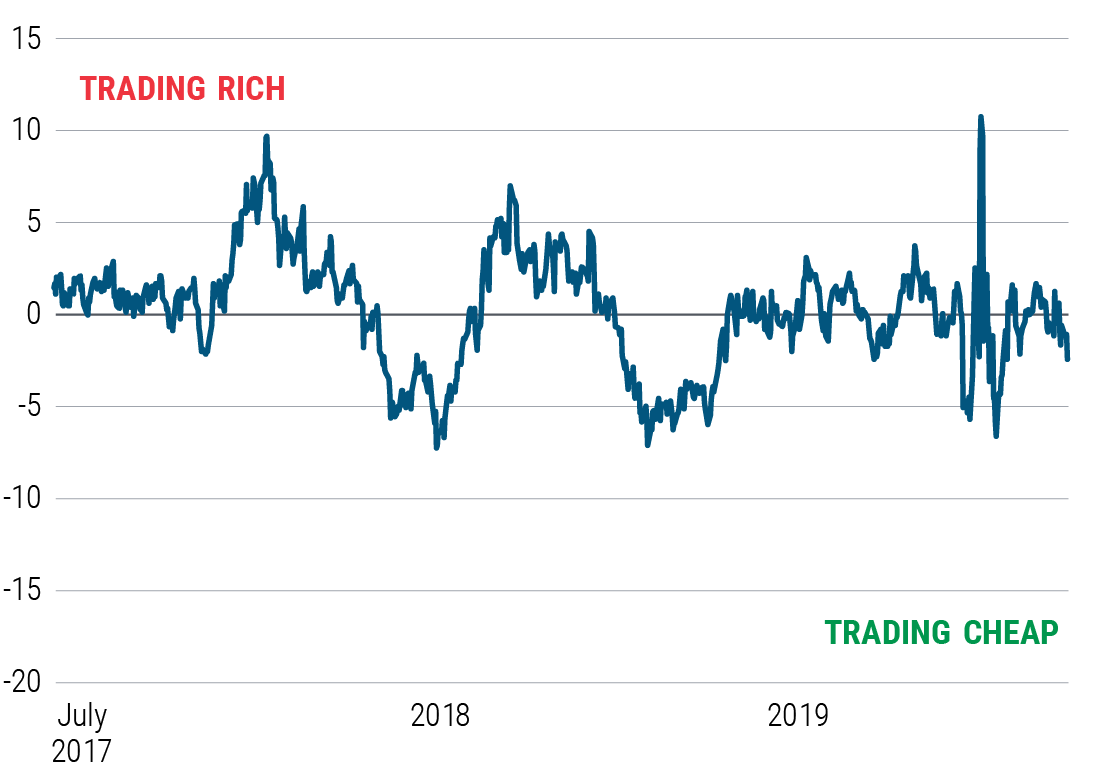

In such unprecedented times, instead of relying solely on long-term valuation anchors, it helps to utilize approaches that attempt to incorporate both sides of the argument. In Figure 2, we show the result of a simple regression analysis to gauge the current state of equity valuations in light of central bank actions and expectations of economic health. We use U.S. data for this exercise given longer available history to estimate whether the S&P 500’s price/earnings (P/E) ratio is rich or cheap given the level of 10-year real yields (as a proxy for central bank action and overall policy support) and consumer sentiment (as a proxy for perceived economic health), also incorporating the rate of inflation.

In this analysis, equities valuations were observed to be cheap for most of the last decade, as low real yields and expansion-level confidence stayed ahead of the rally, and had just hit “fair” in early 2020. Then the sharp sell-off in the first quarter of 2020 dragged equities to record-cheap levels as the market correction was greater than what would have been predicted by the loss of confidence alone. The subsequent rebound has been very strong considering that confidence remains depressed.

According to this approach, equity valuations currently appear to be in the fair zone. The unexplained risk (or residuals) in the regression can be explained by a range of factors: effects of forward guidance not fully reflected in real yields due to the zero lower bound, stimulus programs affecting corporates but not passed through to consumers, and the market’s view on potential future stimulus reducing the risk of a second-wave downturn, for instance. Applying a similar approach to investment grade (IG) and high yield (HY) credit spreads also leads to the same conclusion: that they are currently in roughly fair-valuation territory.

Overall, we believe the performance of procyclical assets over the next few months is likely to be highly influenced by forthcoming news flow. Neither the pandemic and its economic consequences, nor the policy response, is over yet, so one needs to continuously monitor these two offsetting forces. As such, our main takeaway is that in the current environment, we believe investors should maintain a moderate risk-on stance and emphasize relative value opportunities where dislocations remain, thus balancing caution with conviction. What we are quite certain about is that the next few quarters present a great backdrop for active management as sector-level dispersion is likely to remain extremely high. The nature and the pace of the recovery will create many winners and losers, and that should provide a plethora of opportunities to add value through sector selection and tactical asset allocation.

Global equities: Emphasize growth and quality

The unusually wide range of potential outcomes necessitates a nuanced approach across asset classes. We believe multi-asset portfolios should be structured to ensure a healthy participation if an optimistic V-shaped recovery scenario were to be realized, while remaining resilient if the recovery is slow and the environment remains turbulent. In the current environment we prefer a growth and quality tilt within equities.

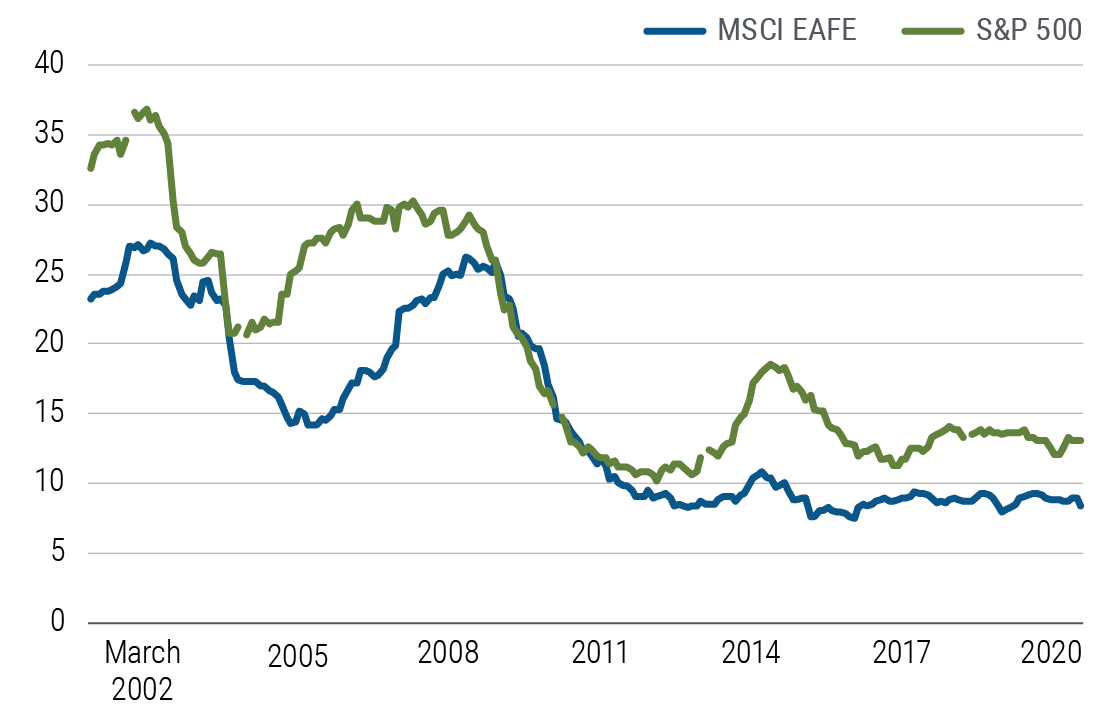

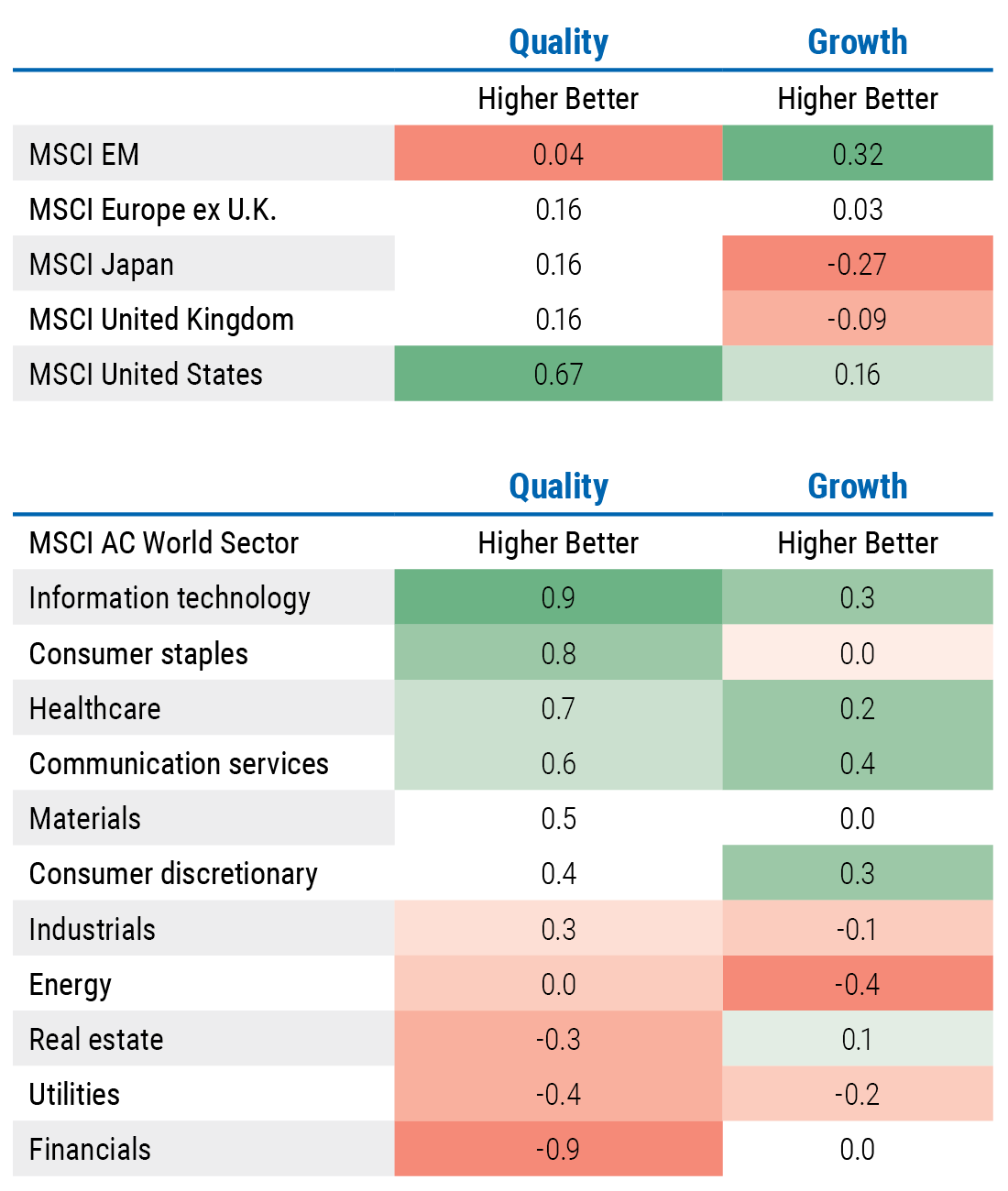

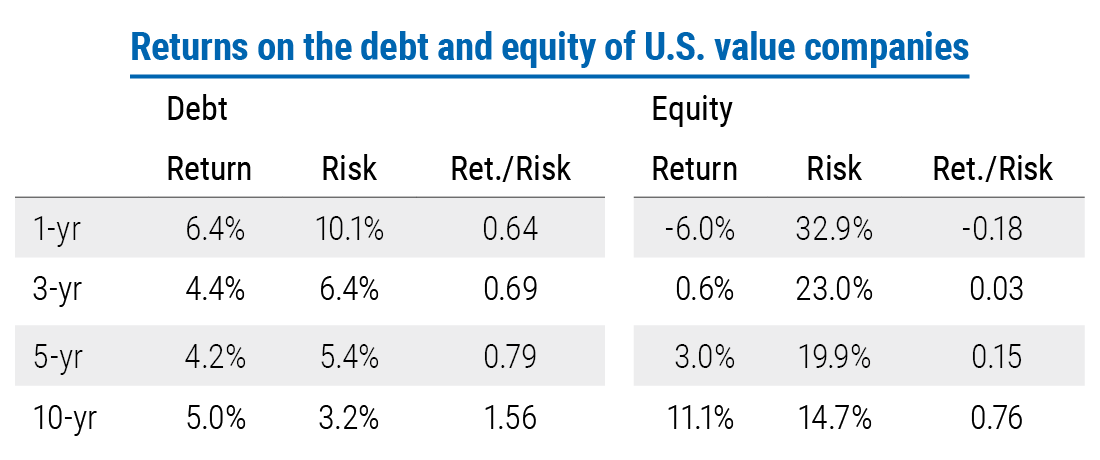

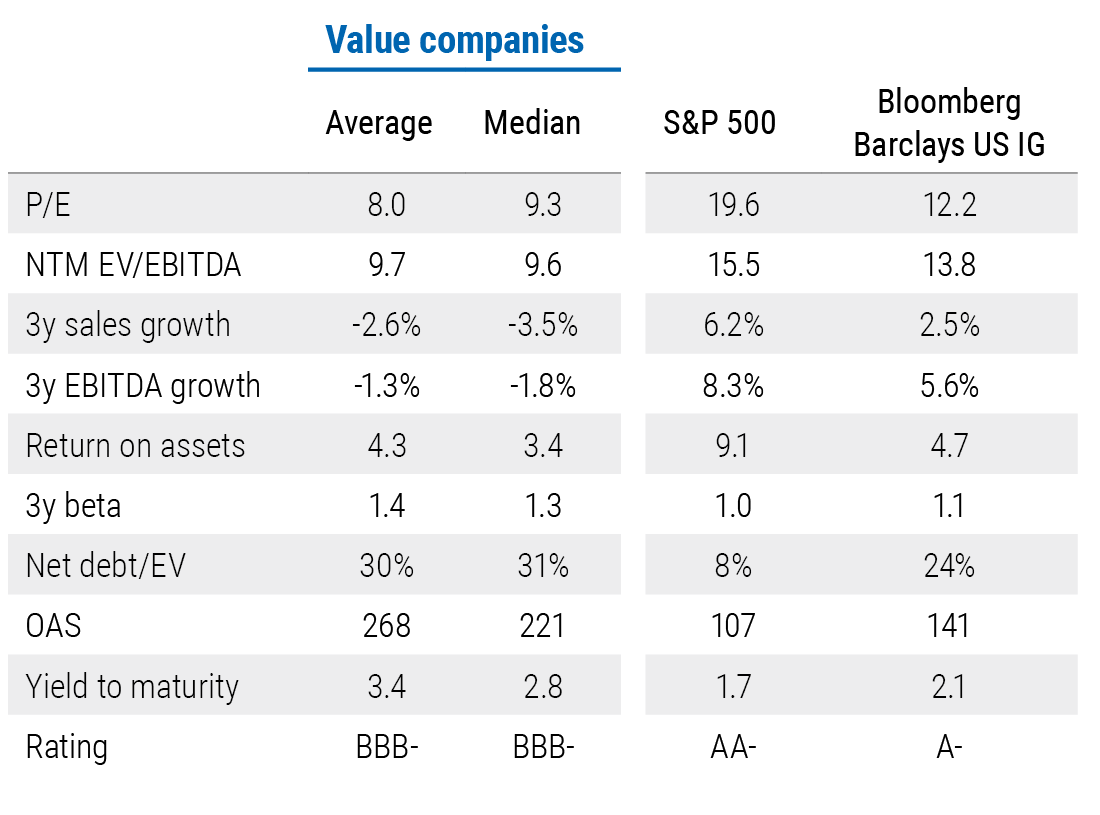

PIMCO’s expectation is for weak global growth over the next 12 to 24 months, with significant downside risks associated with the current health crisis and rising economic protectionism. Yet an extended period of disinflationary growth doesn’t have to be negative for asset prices, but should favor business models and companies with above-average levels of profitability. In contrast, cyclically oriented companies will likely be less resilient if the recovery proves to be slow. For these reasons, we are favoring companies that we believe can reliably generate attractive earnings growth across a range of economic environments, a cohort that has been steadily shrinking over the last few decades (see Figure 3).

In our framework, high quality growth favors the U.S. from a regional perspective given its stable profit growth profile and generally high ROE (return on equity) versus the rest of the world (see Figure 4). Despite cheaper valuations, equity regions outside the U.S. tend to have greater sensitivity to the growth cycle and may face stiffer challenges in the near term.

Across equity market regions, we are currently overweight U.S. equities given the higher share of high quality and growth companies. We are also overweight Japan, which has improving quality characteristics, attractive valuations, and cyclical exposure that is more tilted toward sectors we favor. We are underweight emerging markets and European equities, as these regions are more cyclical and therefore less resilient to a downside scenario.

From a sector perspective, we favor technology and healthcare where innovation is occurring. We believe disrupters in these industries have the potential to deliver high earnings growth in an otherwise low-growth world. We are also emphasizing companies in other sectors that we believe demonstrate growth, high profitability, free cash flow generation, and balance sheet strength.

Traditional credit: Relative value opportunities abound

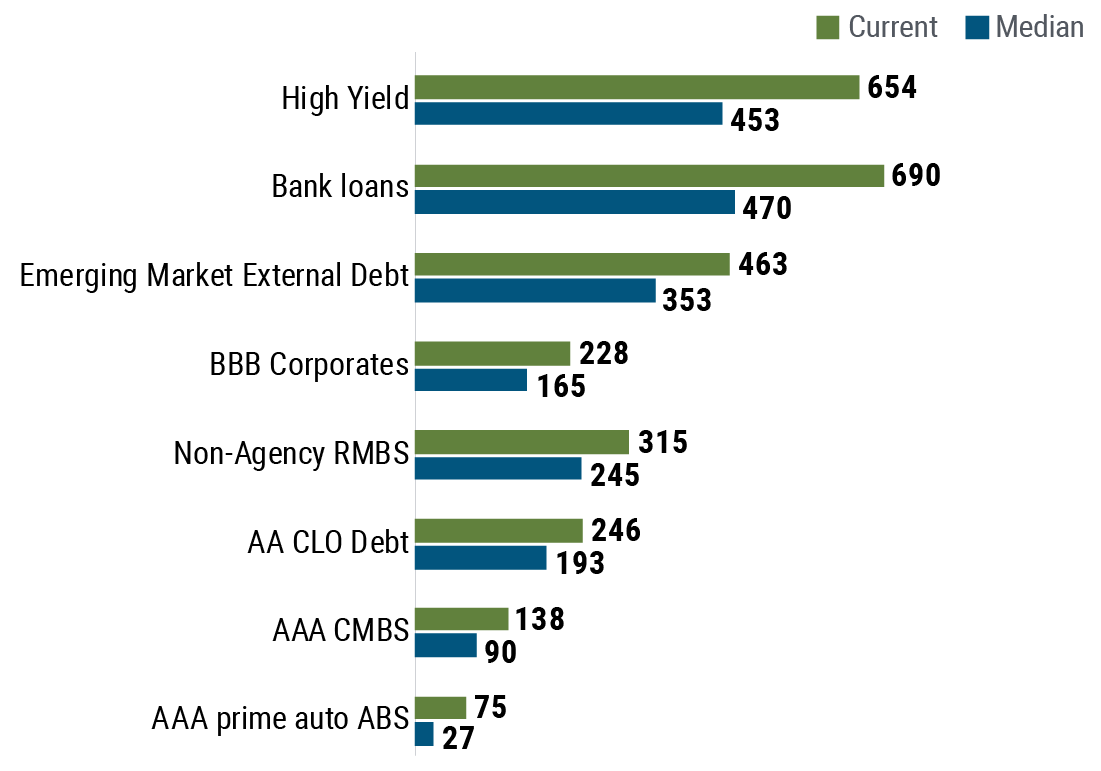

Given the strong market rally across most corporate credit sectors, we are focusing on relative value opportunities and are reducing cyclical exposures on the margin. Owning broad index exposure is no longer as attractive as it was at the end of the first quarter, and credit allocations need to be built on a bond-by-bond basis to achieve maximum portfolio resiliency.

We currently prefer high quality investment grade corporates that we think may provide attractive risk-adjusted returns across a range of recovery scenarios. We also see opportunities in select senior financials and bank capital, as well as noncyclical BB rated high yield credits.

In other credit sectors, we are overweight agency mortgage-backed securities (MBS). Agency pass-through securities appear to be trading at attractive valuations and stand to benefit from ongoing policy support. They also provide an opportunity to go up in credit quality while offering similar yield and better liquidity.

Last, we favor European peripherals given their current spreads and because we expect the policy support to continue.

Overall, we are cautious about exposure to highly levered entities in the current environment. PIMCO leverages its size and scale in an effort to negotiate generous terms from debt issuers. We are also working closely with issuers to structure deals such that our investors may benefit from a new issue premium while seeking to build in protections even if this challenged environment lingers for longer than expected.

Attractive opportunities in nontraditional credit

Moving beyond the equity and debt of public corporations, dislocations in other parts of the credit markets have created attractive risk/reward opportunities. Similar themes apply; we are focusing on investments that we believe can weather a range of economic outcomes rather than narrowly reaching for yield.

We continue to find value in structured credit markets, particularly AAA rated senior securities backed by a diversified pool of assets; examples include commercial MBS, residential MBS, and collateralized loan obligations (CLOs). Legacy non-agency MBS remain attractive from a valuation perspective. U.S. housing fundamentals entered the COVID-19 crisis with positive momentum. Healthy household balance sheet leverage, good affordability, no excess inventory, and positive home price trends are all supportive. The government response is focused on maintaining stability in the housing sector through foreclosure moratoria, payment forbearance, and other stimulus in an effort to prevent default; indeed, high-frequency data show a recovery in activity and stability in prices.

Within emerging markets (EM), we are emphasizing external debt over asset classes that tend to be highly growth-sensitive, such as EM equities, currencies, and local debt. Many EM countries share features of typical value stocks, such as challenged growth models and weak balance sheets. However, hard currency sovereign bonds issued by countries with stronger balance sheets look attractive.

The next wave: Private debt opportunities

Private markets move more slowly than public markets, taking longer for signs of stress to appear. We are starting to see compelling opportunities in certain segments, like CMBS and private loans. We expect further repricing to occur in private debt markets over the next 12 months, reflecting weaker economic conditions and less competition from lenders. Additionally, companies previously able to access traditional sources of financing may be forced to turn to private capital sources. Over the next few years, a wave of bankruptcies may occur in parts of the commercial real estate and corporate markets as highly leveraged borrowers succumb to the challenges posed by new economic realities.

For patient investors with capital to deploy, there should be opportunities to capitalize on dislocations and structure new deals on attractive terms. Markets are also placing a higher price on liquidity, which means that compensation for reduced liquidity has increased.

For these reasons, we believe opportunistic strategies will play an increasingly important role in many investor portfolios in the coming years, as they seek to achieve their long-run return objectives.

Recalibrating portfolio diversification

Similar to the procyclical portion of a multi-asset portfolio, the risk mitigation component calls for a nuanced approach in the current environment. Instead of relying on duration as the sole anchor to windward, we believe investors need to employ a much broader toolkit consisting of diversifying assets with explicit or implicit government support, risk-off currencies, and alternative assets and strategies.

The core issue facing investors is the paucity of low-risk, perceived “safe” assets with an acceptable level of yield. The policy action and risk aversion in response to COVID-19 has forced developed market sovereign bond yields to even lower levels (see Figure 8).

Despite the yield backdrop, we believe interest rate duration plays an important role in multi-asset portfolios; many investors experienced the benefit of high quality duration this year amid the sell-off. However, we believe a targeted approach to sourcing duration that focuses on specific regions and parts of the yield curve is needed to maximize return and diversification potential. While term premia are low across the board, we favor the U.S. and Australia given higher yield levels and therefore more room to fall in a flight-to-quality event. We prefer sourcing duration around the 10-year point of the curve in these countries, as most central banks are at the lower bound and curves are flat out to the five-year point. Should a faster-than-expected economic recovery occur, the 30-year point will tend to suffer disproportionately as curves steepen.

Some investors are rightfully concerned whether the stock-bond correlation will remain negative, U.S. Treasuries have historically provided a positive nominal return in every single U.S. recession over the past five decades regardless of the sign of their correlation with equities. We think this relationship will continue to hold, although the level of convexity and return potential of duration is limited by the low level of yields.

We believe a well-diversified and targeted duration position should be complemented with other risk-mitigating assets. The opportunity set can consist of risk-off currencies such as the Japanese yen and Swiss franc, high quality assets receiving policy support such as agency MBS and AA/AAA rated IG corporates, as well as diversifying alternative strategies.

Investors can also consider allocations to gold, which tends to be a resilient asset and has delivered diversification in many past recessions and periods of high macro uncertainty. We note that a majority of movement in gold prices can be explained by movement in real yields. When real yields rise, gold prices tend to fall to maintain its demand relative to other investment opportunities, and when real yields fall, gold prices tend to rise. Investors should be aware of this relationship because it has important implications for the role gold can play in their portfolios. Based on our valuation model of gold and real yields (see Figure 9), we believe gold is currently slightly cheap versus real yields.

While the approach we outline above of “diversify your diversifiers” is necessary, it may not be sufficient. Every effort should be made to ensure that the offensive portion of the portfolio on its own is highly diversified and robust across a range of recovery scenarios, as we highlighted in the previous section. The ability to be tactical in response to evolving macro and health conditions is going to be critical in managing downside risk and underscores the importance of ensuring that a portfolio is carefully managing its liquidity profile and is compensated for less liquid exposures.

Conclusion

While PIMCO’s baseline economic forecast calls for a gradual healing of global activity through the second half of 2020 and into 2021, the range of potential outcomes is wide and uncertainty is high. In such an environment, building resiliency in portfolios is key, with a focus on hedging the downside risk while also maintaining positive upside convexity.

We believe equities and corporate credit are fairly valued when adjusting for real interest rates, economic resilience, and the level of inflation. As such, we favor a moderate risk-on stance in multi-asset portfolios with a focus on companies with strong secular or thematic growth drivers that are positioned to deliver robust earnings in a tepid macro environment. This approach favors quality and growth over cyclical risk in equity portfolios, and favors “bend but not break” investments in credit markets.

In an environment where risks remain skewed to the downside, we believe portfolio diversifiers remain crucial to helping insulate investors from adverse scenarios. High quality, “safe haven” assets like duration continue to play an important role in portfolio construction, despite record low yields. However, we suggest investors employ a much broader toolkit consisting of diversifying assets with explicit or implicit government support, risk-off currencies, as well as alternative assets and strategies. Portfolios that are thoughtfully constructed, well-diversified, and sufficiently nimble will likely be in the best position to navigate the months ahead.

The authors would like to thank Bill Smith, Emmanuel Sharef, Brendon Shvetz, Ashish Tiwari, Jason Odom, and Dan Phillipson for their contributions to this paper.

Download PIMCO's Asset Allocation Outlook

Download PDFFeatured Participants

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Sovereign securities are generally backed by the issuing government. Obligations of U.S. government agencies and authorities are supported by varying degrees, but are generally not backed by the full faith of the U.S. government. Portfolios that invest in such securities are not guaranteed and will fluctuate in value. Inflation-linked bonds (ILBs) issued by a government are fixed income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government-agency or private guarantor, there is no assurance that the guarantor will meet its obligations. REITs are subject to risk, such as poor performance by the manager, adverse changes to tax laws or failure to qualify for tax-free pass-through of income. Collateralized Loan Obligations (CLOs) may involve a high degree of risk and are intended for sale to qualified investors only. Investors may lose some or all of the investment and there may be periods where no cash flow distributions are received. CLOs are exposed to risks such as credit, default, liquidity, management, volatility, interest rate and credit risk. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be suitable for all investors. Private investment strategies involve a high degree of risk and prospective investors are advised that these strategies are appropriate only for persons of adequate financial means who have no need for liquidity with respect to their investment and who can bear the economic risk, including the possible complete loss, of their investment. Diversification does not ensure against loss.

The credit quality of a particular security or group of securities does not ensure the stability or safety of an overall portfolio. The quality ratings of individual issues/issuers are provided to indicate the credit-worthiness of such issues/issuer and generally range from AAA, Aaa, or AAA (highest) to D, C, or D (lowest) for S&P, Moody’s, and Fitch respectively.

Management risk is the risk that the investment techniques and risk analyses applied by an investment manager will not produce the desired results, and that certain policies or developments may affect the investment techniques available to the manger in connection with managing the strategy.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fees, and/or other costs. In addition, references to future results should not be construed as an estimate or promise of results that a client portfolio may achieve.

The terms “cheap” and “rich” as used herein generally refer to a security or asset class that is deemed to be substantially under- or overpriced compared to both its historical average as well as to the investment manager’s future expectations. There is no guarantee of future results or that a security’s valuation will ensure a profit or protect against a loss.

A “safe haven” is an investment that is perceived to be able to retain or increase in value during times of market volatility. Investors seek safe havens to limit their exposure to losses in the event of market turbulence. All investments contain risk and may lose value.

Beta is a measure of price sensitivity to market movements. Market beta is 1. Correlation is a statistical measure of how two securities move in relation to each other. Duration is the measure of a bond's price sensitivity to interest rates and is expressed in years. The option adjusted spread (OAS) measures the spread over a variety of possible interest rate paths. A security's OAS is the average earned over Treasury returns, taking multiple future interest rate scenarios into account. P/E Ratio, Weighted Average Market Cap. and Median Market Cap. are the averages of the P/E and market capitalization of the issues held by the portfolio. P/E is a ratio of security price to earnings per share. Typically, an undervalued security is characterized by a low P/E ratio, while an overvalued security is characterized by a high P/E ratio.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. It is not possible to invest directly in an unmanaged index. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2020, PIMCO.