Seven Macro Themes for 2020

- Recession risks have diminished, and we are more confident in our baseline forecast of a moderate recovery in global growth this year.

- But monetary policymakers now have even less space left to guard against future recessions.

- Thus, while “time to recession” has likely increased with last year’s monetary easing, so has “loss given recession.”

- Considering the outlook, we seek to invest with a bias to higher-quality positions, a very close focus on portfolio liquidity, and a diversified approach to generating income.

As a turbulent year for the global economy, financial markets, and politics recedes in the rearview mirror, we look ahead into 2020, mapping out both the likely path and the potential roadblocks for the economy and investors. This outlook draws on the work by PIMCO's portfolio managers, economists, and analysts in preparation for our recent quarterly Cyclical Forum, the lively discussions among our investment professionals at the event itself, the presentations by our sector specialists during the following two strategy days, and the investment conclusions drawn by our Investment Committee afterward. (For more details on our process, visit the Our Process page.)

Last year was not for the fainthearted: Global growth was "synching lower " and entered a "window of weakness ," the U.S.–China conflict and Brexit uncertainty provided dark mood music, climate concerns took center stage amid extreme weather around the globe, and protests against the political establishment reverberated through Hong Kong, Lebanon, Chile, Ecuador, and many other places. And yet, spurred by global monetary easing led by the U.S. Federal Reserve's dovish pivot in early 2019, both equities and bonds had a year of stellar returns.

Looking ahead, we don't pretend to know what 2020 will bring in terms of economies, politics, and markets – nobody does. But in order to invest, we must couple our rigorous bottom-up portfolio process with taking an educated guess on the most likely baseline and, even more importantly, the skew of risks and opportunities around that baseline compared with what is priced into markets. That's why we spend much time at our quarterly forums mapping out different scenarios with the help of data, models, and premortems (as recommended by PIMCO advisor and Nobel laureate Richard Thaler) in order to check our biases, challenge our own and others' consensus views, and generate investment ideas that will help us manage the risks and target the opportunities we identify.

Seven macro themes for 2020

Based on the discussions during and following last month's forum, here are our key macro themes for 2020 and how we position portfolios for each of them.

1. 'Time to recession' has increased

Recession risks, which had been elevated during the middle part of 2019, have diminished in recent months, helped by additional global monetary easing, a trade truce between the U.S. and China, better prospects for an orderly Brexit, and early signs of a rebound in the global purchasing managers' indices (PMIs). This assessment is corroborated by an easing of the 12-month-ahead recession probabilities for the U.S. estimated by our various U.S. recession models.

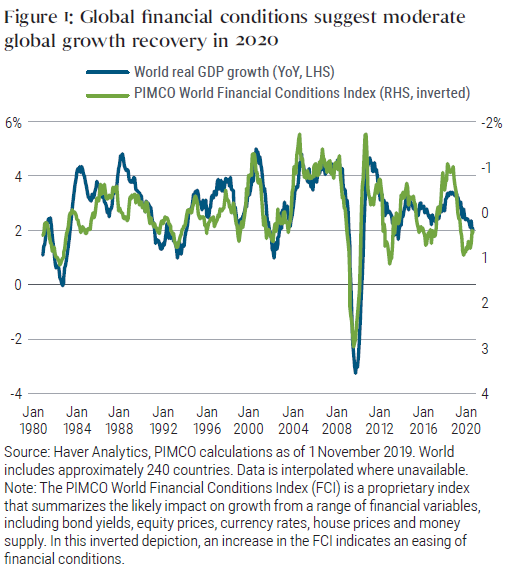

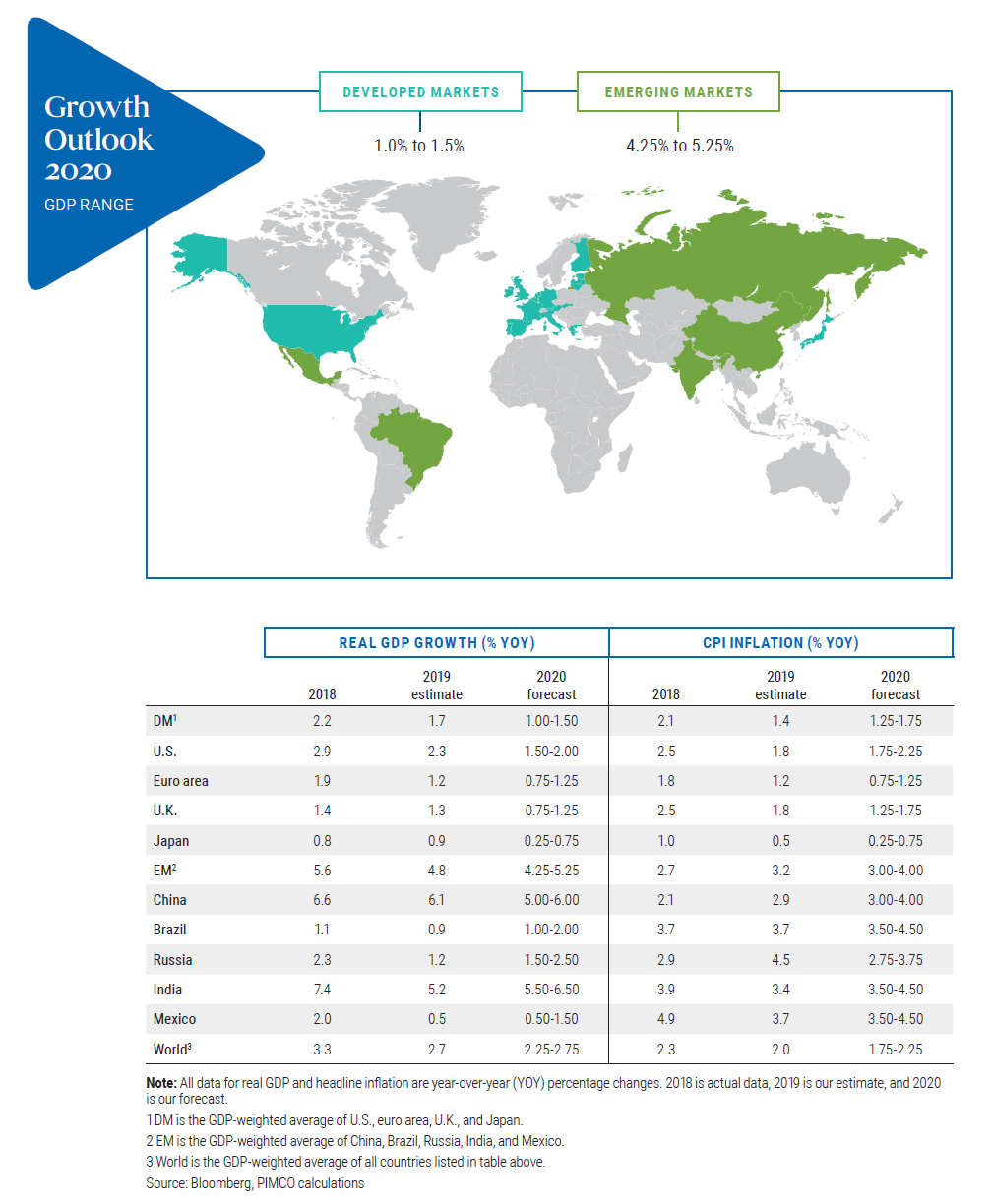

As a consequence, we are now more confident in our baseline forecast that the current window of weakness for global growth will give way to a moderate recovery during 2020. World GDP growth, which has been slowing over the past two years, has yet to bottom. However, PIMCO's World Financial Conditions Index, which tends to lead output growth, has been easing (rising) in recent months, pointing to a moderate cyclical growth recovery in the course of this year (see Figure 1).

Another factor underpinning a likely pickup in global growth this year is the supportive stance of fiscal policy in major economies such as China, Europe, and Japan. With fiscal and monetary policy now working in the same direction – further easing – in almost all major economies, the outlook for a sustained economic expansion over our cyclical horizon has improved. For snapshots of our economic outlook in the major economies, see the section on our regional forecasts further below.

Investment implications of Theme 1

We expect to run a little less duration in our portfolios, with duration close to flat as our starting point and adjusted from there depending on the balance of risk positions in the portfolio. We want to have a constructive approach, with positive carry versus benchmarks, in order to seek to generate income and outperform in the baseline scenario. But we will do this with a bias toward higher-quality positions, a very close focus on portfolio liquidity, and a preference for a diversified approach to generating income. We prefer not to rely excessively on generic corporate credit given concerns over valuations and market liquidity, and the potential for poor performance amid a worse macro outcome than we are expecting or in the event of an overall rise in market volatility in which investors demand a higher risk premium for investing in corporate credit. Within credit, we expect to favor financials over industrials. In asset allocation portfolios, we expect to have a modest overweight to equities, with profit growth likely to provide support in spite of fairly elevated valuations.

2. But 'loss given recession' has likely increased, too

Yet again, the Fed and other major central banks have helped to extend the global expansion by adding stimulus in response to rising recession risks. However, last year's easing of monetary policy comes at a price: Whenever the next economic downturn or major risk market drawdown hits, policymakers will have even less policy capacity to maneuver, thus limiting their ability to fight future recessionary forces. Thus, while "time to recession" has likely increased with last year's monetary easing, so has "loss given recession."

To be sure, this is not a criticism of central banks' easing actions last year. Hoarding rather than using the policy toolkit is usually not a good idea in the face of rising recession or deflation risks. Rather, these call for aggressive and preemptive action early on to nip them in the bud. This is what both the Fed and the European Central Bank (ECB) attempted last year in response to rising risks and uncertainties, and the first indications are that they were successful in countering these risks. Still, an inevitable consequence of cutting rates further toward the effective lower bound is that there is now less monetary policy space available for future action.

A common response to the above is that while monetary policy has less space, fiscal policy can and should step in and save the day whenever the next recession looms. After all, low interest rates coupled with central banks' ability and willingness to purchase (more) government bonds create more fiscal space for governments. In theory, we agree and have in fact argued for some time that fiscal policy is likely to become more proactive in the future. In practice, however, it is unlikely that governments and parliaments are able to diagnose recession risks early enough and, even if so, implement fiscal easing in time to prevent a recession, given the slow way in which political processes usually work. Thus, central banks will still have to be the first responders in the next crisis and, again, will be more constrained than they have been in the past.

Another way last year's monetary easing may increase "loss given recession" is that the combination of a longer expansion and a longer period of even lower rates and "QE infinity" (i.e., central bank asset purchases, or quantitative easing, with no clear end date) incentivizes companies and households to increase leverage, which could come back to haunt them and their creditors in the next downturn.

Investment implications of Theme 2

We will tend to favor U.S. duration over global alternatives, given the relative value and potential for capital gains in U.S. Treasuries and the scope for further Fed easing in the event of a weaker-than-expected macro outcome. While we are broadly neutral on the U.S. dollar versus other G10 currencies, we generally will favor long yen positions in accounts where currency exposure is appropriate, reflecting the combination of what we believe is cheap valuation and the risk-off nature of a long yen position (which can be a proxy for duration exposure). In credit, as well as the overall cautious stance on generic credit risk, we expect to favor short-dated, default-remote "bend but don't break" corporate exposures, being extra cautious in the current stage of the credit cycle of what fits into this category.

3. Potential cracks in the corporate credit cycle

As part of our forum discussions and following the suggestion by Richard Thaler, we engaged in a couple of premortems – exercises in "prospective hindsight" intended to mitigate groupthink and overconfidence in a particular baseline scenario. For one of the premortems, we asked our U.S. team to assume that the economy falls into recession in 2020 and suggest a plausible narrative of how and why this happened. The team zoomed in on vulnerabilities in the riskier segments of the corporate credit market that could exacerbate a further slowdown of growth and turn it into a recession. The story goes as follows:

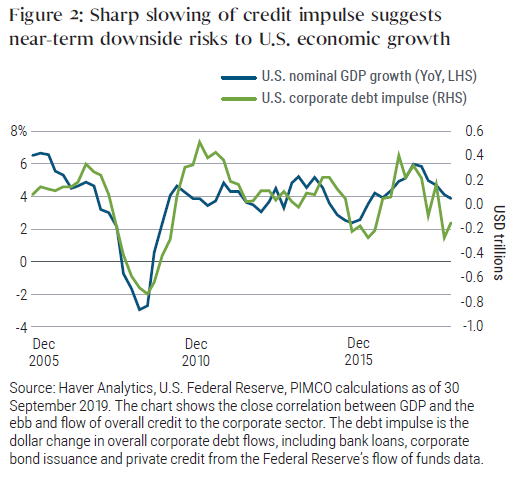

Back in 2017 and 2018, due in part to a notable increase in nonbank loans to U.S. small and midsize firms that couldn't get credit from banks, the corporate credit impulse (i.e., the change in overall credit flows, which is highly correlated with GDP growth – see Figure 2) accelerated dramatically. These firms benefited from strong global growth and U.S. fiscal stimulus and were driving the acceleration in private sector job growth. However, when GDP growth decelerated during 2019 from 3% to 2%, private credit lending activity ground to a halt and, in addition, banks tightened standards on commercial and industrial loans.

According to Federal Reserve data, private credit is a roughly $2 trillion market, or 9% of U.S. GDP, which makes a slowdown in this engine of credit growth seem manageable in the context of a robust labor market and healthy consumers. However, if growth slows further in 2020 rather than picking up during the year as in our baseline, the riskier segments of the credit market would seem vulnerable. Private credit, leveraged lending, and high yield debt have been concentrated in businesses that are highly cyclical and have riskier credit profiles. Moreover, despite solid bank equity positions, post-crisis regulation creates incentives for banks to ration credit when heading into a downturn. With speculative grade lending currently around 35% of GDP, stress across these sectors would be more than enough to contribute to a recession.

Again, our base case is that growth picks up in the course of 2020 and thus the "financial accelerator" does not kick in to propagate a default cycle and recession (note that the term was introduced by current PIMCO advisor Ben Bernanke and co-authors in 1996). However, in our view, these corporate credit vulnerabilities warrant close attention especially if growth should fall short of our and consensus expectations this year.

Investment implications of Theme 3

This theme reinforces the case for a defensive stance on generic corporate credit. In addition, in asset allocation portfolios, we will look to be overweight large cap over small cap equities.

4. Home sweet home

We expect the housing market to be an area of strength in the U.S. economy this year and beyond. The decline in mortgage rates in 2019 has brought buy-to-rent and payment-to-income affordability ratios back to November 2016 levels. Moreover, credit score requirements for new mortgages have eased year-over-year.

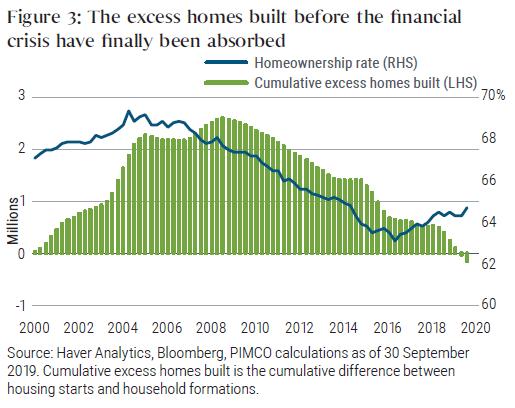

Meanwhile, the excess homes built pre-crisis have finally been digested (see Figure 3) and we are now entering a period of overall scarcity across the U.S. Housing vacancy and inventories are at their lowest levels since 2000, while household formations are once again picking up, arguing for an increase in investment needed to grow the housing stock. Our mortgage team expects U.S. home prices to appreciate by some 6% cumulatively over the next two years.

Investment implications of Theme 4

We favor both U.S. agency mortgage exposures and non-agency exposures. We believe agency mortgage-backed securities (MBS) offer attractive valuation, reasonable carry, and an attractive liquidity profile in comparison with other spread assets. We see non-agency mortgages as offering relatively attractive valuation along with a more defensive source of credit and carry and better market technicals than generic corporate credit exposure. We will also look to have select commercial MBS (CMBS) exposures. U.K. residential MBS (RMBS) also looks attractive on a relative valuation basis.

5. The world leads, the U.S. lags

Just as the U.S. cycle lagged behind the global cycle during 2018 and 2019 with the U.S. economy slowing later and by less than the rest of the world, we expect global growth to trough out and rebound earlier than U.S. growth this year.

Signs of a rebound already started to show up late last year in the global PMIs, particularly in emerging markets, and in other business surveys that are sensitive to global trade and manufacturing, such as the German Ifo survey. Meanwhile, in the U.S. our leading indicators suggest that GDP growth could slow further to around 1% annualized in the first half of this year before picking up again (Figure 4). Moreover, potential temporary production cuts in the U.S. airline industry could shave off another 0.5 percentage points from first-quarter annualized GDP growth, though this would likely be largely recovered assuming production resumes in the second quarter as is widely expected.

Another factor that could hold back U.S. animal spirits and growth this year would be a possible increase in political uncertainty ahead of the U.S. elections, particularly if progressive high-tax, high-regulation Democratic candidates gain more support during the primaries. This would most likely weigh on business sentiment and investment spending and could lead to a tightening of financial conditions via lower expected equity returns.

Taken together, U.S. growth momentum may lag global growth momentum at least for some time during the first half of 2020.

Investment implications of Theme 5

We expect to favor U.S. duration over other global sources of duration. In currency strategy, we look to be overweight a basket of emerging market currencies versus the U.S. dollar and the euro. We will watch closely for other opportunities to be long G-10 currencies versus the U.S. dollar if we see more evidence of a relative shift in momentum from the U.S. to the rest of the world.

6. Inflation: The devil they prefer

While our baseline forecast is for benign inflation in the advanced economies over our cyclical horizon, we believe medium-term upside risks outweigh downside risks, especially given how little inflation is priced into markets.

One reason is that labor markets have continued to tighten, and wage pressures, though still very moderate given the low level of unemployment, have been picking up recently. If unemployment falls further as economic growth recovers this year, wage pressures are likely to intensify over time, and firms will find it easier to pass on cost increases as demand improves.

Also, with fiscal policy likely to become more expansionary over time, in line with our view that "fiscal is the new monetary ," nominal demand should be better supported, especially if central banks play ball and don't aim to offset fiscal easing with monetary tightening as the Fed did in 2018.

Last but not least, after many years of missing their inflation targets on the downside, virtually all major central banks seem to prefer inflation (the devil they know) over deflation (the devil they don't know). While any changes resulting from the Fed's ongoing and the ECB's upcoming strategic review are likely to be evolutionary rather than revolutionary, we expect a nod toward average inflation targeting in the U.S., and a more symmetric 2% inflation target or target band centered around 2% in the euro area, implying a higher tolerance by two major central banks for potential inflation overshoots.

Against this backdrop, and despite the expected global growth recovery this year, we see the major central banks largely on hold this year and expect the bar for tighter policy to be generally higher than the bar for further easing. While discomfort with negative interest rates in Europe is rising given the unpleasant side effects, the ECB is very unlikely to exit until well beyond our cyclical horizon.

Investment implications of Theme 6

We will tend to favor curve steepening positions in the U.S. and in other countries, reflecting valuations but also reflecting the combination of front ends anchored by central banks – that will be reluctant to tighten policy – and the potential for higher inflation expectations to be priced in further out the curve. Curve steepening positions should also provide our portfolios with some cushion given the rise in U.S. government deficit and debt and the possibility that, over time, markets will demand more term premium in the event of further deterioration in the fiscal outlook. U.S. Treasury Inflation-Protected Securities (TIPS) look attractive on a valuation basis and, given the high bar for the Fed to hike rates, even in a somewhat stronger environment. While the outlook for inflation is subdued, the balance of risks is toward a higher inflation outlook than the relatively depressed level priced into TIPS breakevens.

7. Dealing with disruption

While our baseline economic outlook of a moderate pickup in global growth amid supportive monetary and fiscal policy is relatively benign, we remain cognizant of the potential for significant bouts of volatility caused by geopolitics and national politics around the world.

While a limited Phase 1 trade deal between China and the U.S. is in the making, relations between the established power U.S. and the rising power China remain fragile and tensions could easily erupt again during this year.

Another area of focus this year will be the U.S. elections in November. Risk markets will pay close attention as the field of Democratic candidates for the presidency narrows during the primaries.

Moreover, the recent wave of protests against the political establishment across many emerging market economies may spread further, especially as potential growth in many of these economies has downshifted, which increases the dissatisfaction with governments and sharpens the focus on income and wealth inequality.

Thus, as we pointed out in our 2019 Secular Outlook, investors will have to get used to "dealing with disruption " and position their portfolios accordingly.

Investment implications of Theme 7, and overall conclusions

While the baseline outlook for 2020 looks positive, we also recognize risk premia has been compressed by central bank action, leaving little cushion in the event of disruption. We see a range of political and geopolitical risks in addition to the potential for macro surprises, central bank exhaustion, and rising volatility. As well as a close focus on liquidity management, careful scaling of investment positions, and caution on generic credit, we will look to have somewhat lower weight on top-down macro trades, to keep powder dry and potentially go on the offensive in a more difficult investment environment.

Regional economic forecasts

U.S.: Slower growth followed by an eventual rebound

While positive trade developments and easier Fed policy have reduced our near-term probability of recession, we continue to expect real U.S. GDP growth to slow to a 1.5% to 2.0% range in 2020, from an estimated 2.3% pace in 2019. The trend-like forecast for the full year masks a sharper growth deceleration in the near term as the lagged effects of weak global growth, heightened business uncertainty, and slower corporate profit growth continue to weigh on business investment and hiring. However, domestic and global government and central bank policy actions to ease financial conditions, lower rates, and stimulate growth should ultimately counteract the slowdown, and we look for a modest U.S. reacceleration in the second half of 2020. China's commitments in the Phase 1 trade deal to purchase $200 billion of additional U.S. exports over the next two years should also support growth in the second half of 2020.

Despite the announced small reduction in tariff rates on some Chinese goods, we expect core consumer price inflation to firm modestly further in the next few months, before moderating in the later part of 2020. Given manageable inflationary pressures and core PCE (personal consumption expenditures) inflation below the Fed's 2% target, we see a high bar for the Fed to return to rate hikes in 2020. At the same time, we see a lower bar for some further modest easing as U.S. growth slows somewhat further in the next several months, and the risks of recession, while lower than in September 2019, are still elevated relative to historical experience.

Euro area: The 1% economy continues

We expect euro area growth to reaccelerate gradually on the back of an improved global trade environment and ongoing support from monetary and fiscal conditions. Germany in particular should show some recovery following the recent patch of stagnation. Increasing signs of spillover from the manufacturing weakness into the broader labor market, and lingering uncertainty over a fragile trade truce between the U.S. and China, on the other hand, will likely limit the strength of the upswing. We see euro area growth at around 1.0% in 2020.

Inflation, meanwhile, looks set to remain low. We see some pass-through of recent wage increases into core services inflation. But the rise is likely to be muted, as wage inflation is likely to flatline ahead in an environment of weaker growth, and as corporate pricing is likely to remain cautious in the current uncertain growth environment. Another factor pushing up core inflation will be the lagged effect of the recent currency depreciation on core goods prices, although the relationship between currency changes and core prices looks to have weakened of late. On balance, we see core inflation remaining close to 1.0%.

On policy, we don't expect any new measures from the ECB, which is likely to keep the policy rate at −0.50% and continue net asset purchases of €20 billion per month through the forecast horizon. If additional easing is needed, the focus will likely be on forward guidance, QE and longer-term refinancing operations (LTROs), given increasing concerns about the side effects of deeper negative rates.

U.K.: The end of the beginning

The U.K. is set to formally leave the E.U. at the end of January, after which we expect the two sides to negotiate a limited free trade agreement, concentrated on goods. If the trade negotiations are inconclusive, we expect the U.K. to agree to a very narrow deal and in effect extend the transition period or implement temporary side deals, smoothing the transition into WTO trading terms. In any event, we see the risk of the U.K. ending the transition period with no deal as low.

In our baseline, we expect U.K. GDP growth of 0.75% to 1.25% in 2020, modestly below trend. Uncertainty about the precise future trading arrangement between the EU and U.K. will likely continue to weigh on business investment and sentiment. Against that, we expect improving global trade and some fiscal easing to boost activity, especially in the second half of the year.

CPI inflation looks set to be below the Bank of England's 2% target in 2020, in part because of scheduled cuts in regulated electricity and energy prices. While wage growth remains relatively high, we do not expect it to meaningfully feed into higher consumer prices. In this environment, we expect the Bank of England to keep its policy rate unchanged at 0.75%.

Japan: Fiscal stimulus to support growth in 2H 2020

We expect GDP growth to slow to a 0.25% to 0.75% range in 2020 from an estimated 0.9% this year. Growth is expected to slow down in the first half of 2020 due to a negative impact from the VAT hike in the fourth quarter of 2019, but it is expected to pick up in the second half thanks to a large fiscal stimulus package along with steady domestic private demand.

Inflation is expected to remain low in a 0.25% to 0.75% range, with most of the impact from the consumption tax hike to be offset by free nursery education. The tepid growth outlook should also reduce inflationary pressure in the near term.

Policy-wise, "fiscal is the new monetary" in Japan. The government approved a large supplementary budget (2.6% of GDP spending over the next few years) in December, which is likely to support growth in 2020. In case of downside risks to global growth, fiscal support is likely to expand further. On monetary policy, we expect the Bank of Japan to keep the interest rate on excess reserves (IOER) unchanged given improving external risks. The central bank's monetary policy setting is at or close to its exhaustion point and there is a high hurdle to lower IOER given certain negative side effects while the benefit is not certain.

China: Modest set of policies ahead while progress on trade deal is made

We see GDP growth slowing into a 5.0% to 6.0% range in 2020 from an estimated 6.1% in 2019. The Phase 1 trade deal, although with only marginal overall tariff rollback, is welcome as a signal of a turning point away from further escalation. The boost to business and consumer sentiment may help stabilize recent trends of slowing domestic demand, peaking property volume, and sluggish investment spending. Fiscal policy should also provide a partial cushion to growth, and in 2020 we project a fiscal thrust of around 1.0% of GDP focusing on infrastructure investment.

Consumer price inflation has breached the central bank's 3.0% target recently and is likely to stay in the 3.0% to 4.0% range in 2020. Pork prices have been a shock to the food component of CPI and this creates temporary constraints on monetary easing, despite benign producer prices and core inflation.

The People's Bank of China is effectively on hold in an effort to anchor inflation expectations over the cyclical horizon, although it is possible to see small symbolic increments of interest rate cuts, in addition to the recently announced reserve requirement reduction, to contain market moves. Credit conditions we expect will remain relatively tight and policy transmission will be slow, with rising onshore defaults and shadow banking deleveraging. Policymakers have been increasingly using a flexible exchange rate as an automatic stabilizer in 2019; however, we expect 2020 will bring a stable to moderately stronger yuan to limit pass-through from import prices, another element of the trade deal with the U.S.

Featured Participants

Disclosures

The terms “cheap” and “rich” as used herein generally refer to a security or asset class that is deemed to be substantially under- or overpriced compared to both its historical average as well as to the investment manager’s future expectations. There is no guarantee of future results or that a security’s valuation will ensure a profit or protect against a loss.

Past performance is not a guarantee or a reliable indicator of future results.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government-agency or private guarantor, there is no assurance that the guarantor will meet its obligations. Inflation-linked bonds (ILBs) issued by a government are fixed income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Treasury Inflation-Protected Securities (TIPS) are ILBs issued by the U.S. government.

There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

Duration is the measure of a bond's price sensitivity to interest rates and is expressed in years.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.